Advertisement|Remove ads.

Why Analysts See SoFi, Affirm Benefiting From A Credit Card Rate Cap

- Mizuho says the proposal, if implemented, could push banks to tighten lending standards.

- The policy could drive consumers toward alternative lenders such as Affirm Holdings, SoFi Technologies, the brokerage said.

- Analyst Dan Dolev said the shift could unlock meaningful volume growth for fintechs.

President Donald Trump’s proposal to cap credit card interest rates could reshape parts of the U.S. consumer lending market, potentially benefiting fintech lenders and buy now, pay later (BNPL) providers, according to a report citing Mizuho Securities.

Among the top credit card lenders, shares of JP Morgan (-2.5%), Citigroup (-3.8%), and Bank of America (-1.5%) were all down in premarket trading on Monday, while Visa (V) and Mastercard Inc. (MA) fell 1.7% and 1.9%, respectively. Meanwhile, SoFi Technologies (SOFI) and Affirm Holdings (AFRM) were trading in the green.

Trump’s 10% Cap On Credit Card Interest Rates

On Friday, Trump said he is weighing a one-year 10% cap on credit card interest rates, calling current rates of 20% to 30% unreasonably high and framing the move as part of his campaign commitments. Trump said he hopes the rule will take effect on January 20.

The proposal comes as U.S. credit card debt hit a record high in 2025, rising from $1.21 trillion in the second quarter to $1.23 trillion in the third, according to the Federal Bank of New York. Total household debt also climbed by $197 billion in the third quarter, putting it on track to surpass pre-financial-crisis levels. Vanderbilt University researchers estimated last year that a 10% cap could save Americans about $100 billion annually in interest costs.

Why SoFi And Affirm Could Benefit

Analysts at Mizuho Securities say a one-year cap of 10%, well below the current average card annual percentage rate (APR) of around 20%, would likely push banks to tighten lending standards, especially for lower-credit borrowers. If implemented, the policy could reduce access to traditional credit cards and drive consumers toward alternative lenders such as Affirm Holdings, SoFi Technologies, Upstart, and BNPL platforms operated by Block and PayPal.

Mizuho estimates that about half of U.S. consumers have FICO scores (credit scores) below 745, a segment that would be most affected by stricter bank lending. These consumers could increasingly turn to fintech lenders, where consumer credit represents the majority of revenue. Analyst Dan Dolev said the shift could unlock meaningful volume growth for fintechs, provided they can manage underwriting risk effectively.

How Did Stocktwits Users React?

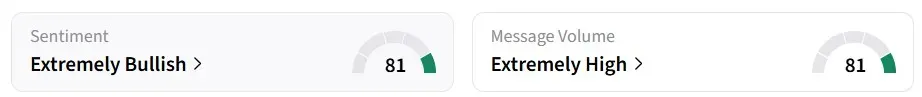

Retail sentiment for SOFI on Stocktwits remained ‘extremely bullish’ over the past 24 hours, amid ‘extremely high’ message volumes.

However, one user expressed skepticism about whether SoFi would actually benefit from a 10% interest rate cap.

Over the past year, SOFI has gained over 90%.

Read also: INBS Stock Has Surged Over 330% So Far In January – But Retail Traders Are Warning Of A Pullback

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_capricor_jpg_9f4f8ab098.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitdeer_OG_jpg_8f9fd0249d.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_US_stocks_3e2253bcca.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Revised_Profile_JPG_0e0afdf5e2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_rolls_royce_jpg_07109534ba.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_kraft_heinz_jpg_4db2a61952.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)