Advertisement|Remove ads.

Will Crypto Thrive In 2026? Coinbase Exec Flags Market Structure As The Big Question

- Coinbase Chief Policy Officer Faryar Shirzad said market structure will be the defining issue for the crypto industry heading into 2026.

- Shirzad warned that applying legacy financial rules to peer-to-peer crypto systems could limit innovation.

- Grayscale and 10x Research have also identified regulatory clarity as a key factor shaping institutional participation and future crypto use cases.

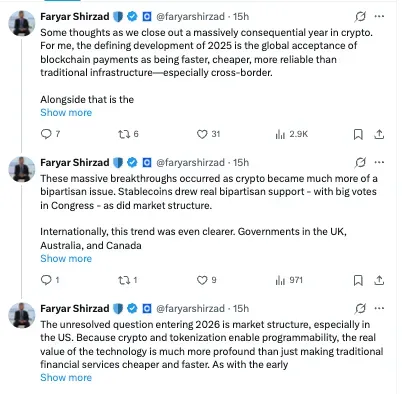

Coinbase Chief Policy Officer Faryar Shirzad said on Monday that the unresolved question facing the crypto industry heading into 2026 is market structure, particularly in the United States.

In a post on X, Faryar Shirzad said Blockchain technology has largely achieved acceptance, but the future depends on whether policymakers adopt regulatory frameworks.

Shirzad argued that the core value of crypto lies not simply in making traditional finance cheaper or faster, but in enabling programmable and open systems for transferring value without intermediaries.

“Peer-to-peer exchanges of value shouldn’t face intermediated finance rules,” Shirzad wrote, adding that clear and proportionate regulation is needed to preserve innovation and competitive markets, as the cryptocurrency industry heads into 2026.

Coinbase (COIN) closed at $233.77 on Monday, down 1.32% on the session, before ticking 0.33% higher in pre-market trading to around $234.53. On Stocktwits, the retail sentiment around COIN remained in ‘bearish’ territory, with ‘low’ levels of chatter, over the past day.

Industry Consensus On Regulatory Risk

Shirzad’s position aligns with recent commentary from industry experts like Grayscale and 10x Research. Earlier this month, Grayscale Investments said in its 2026 Digital Asset Outlook Report that regulatory clarity around market structure is essential for sustaining institutional participation in digital assets, even after the approval of U.S. spot Bitcoin ETFs.

Similarly, 10x Research noted that 2026 is shaping up to be defined by policy shifts, regulatory finality, and market-structure events that will influence how crypto transitions into broader use cases, such as tokenization and decentralized finance.

Shirzad said the central question for 2026 is no longer whether to accept blockchain technology, but whether policy can unlock its next stage of growth before regulatory constraints become binding.

Read also: SEC’s Crypto Policy Under Paul Atkins Questioned By Top House Democrat Maxine Waters

For updates and corrections, email newsroom[at]stocktwits[dot]com

/filters:format(webp)https://news.stocktwits-cdn.com/large_target_logo_resized_jpg_3025bd9bb0.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_dow_jones_jpg_e152f04aaa.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_job_seekers_florida_resized_jpg_742e535d49.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Altcoins_ff3521c963.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stock_price_bitcoin_OG_jpg_d43a7edd5e.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_wall_street_resized1_jpg_7f200ce842.webp)