Advertisement|Remove ads.

Will Supreme Court Rule In Favor Of Trump Tariffs On Friday? Prediction Markets Point To Slim Chances

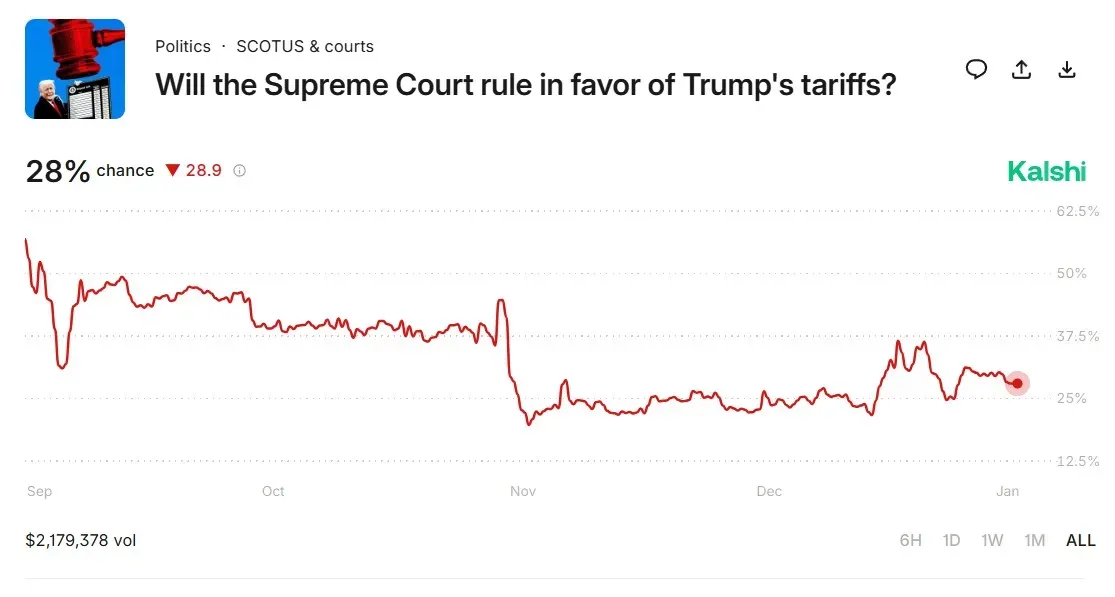

- Data from Kalshi show that users think there is a 28% chance that the Supreme Court will rule in favor of Trump's tariffs by 2028.

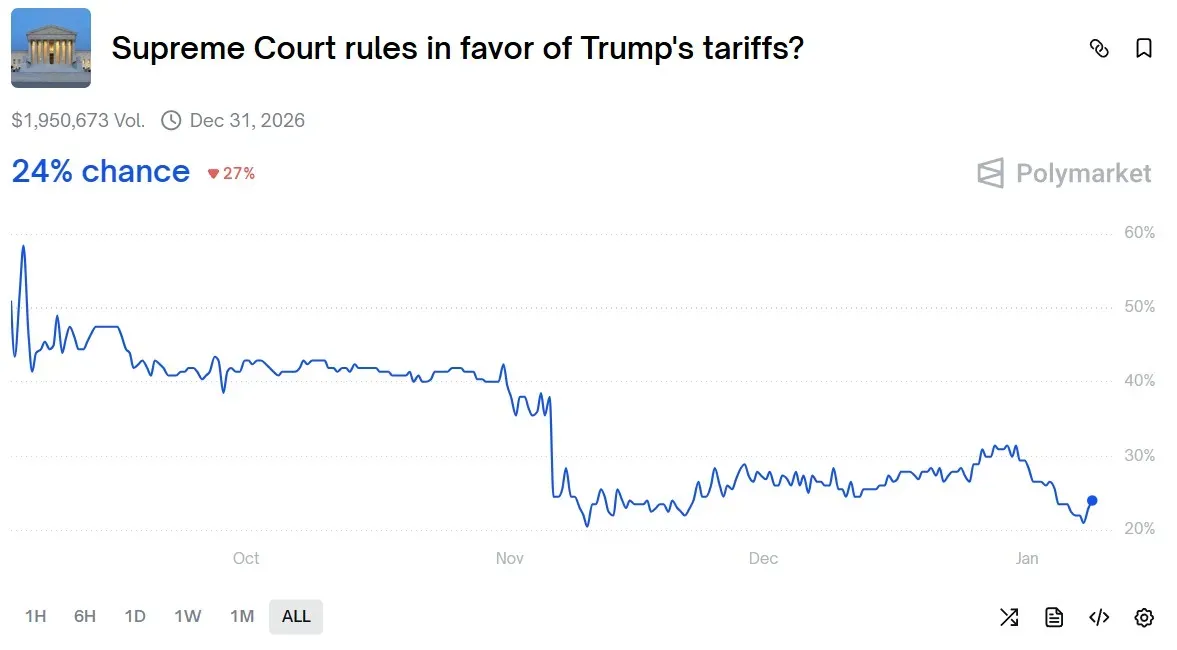

- On Polymarket, bettors think there is an even lesser chance of a positive ruling for the Trump administration, with only 24% expecting a ruling in President Trump’s favor.

- Earlier this week, President Trump stated that the U.S. will soon receive more than $600 billion in tariffs.

As the Supreme Court gears up to weigh the legality of Trump's tariffs, prediction markets are buzzing with bets on the outcome of the case.

Data from popular prediction markets Kalshi and Polymarket show that bets regarding the Supreme Court’s potential decision on Friday are now worth over $4 million. While Kalshi volumes show bets worth more than $2.2 million, Polymarket bets had reached a total of nearly $2 million at the time of writing.

What Are The Prediction Markets Saying?

Data from Kalshi show that users think there is a 28% chance that the Supreme Court will rule in favor of Trump's tariffs by 2028.

On Polymarket, bettors think there is an even lesser chance of a positive ruling for the Trump administration, with only 24% expecting a ruling in President Trump’s favor. Both the bets require an official announcement from the Supreme Court.

Supreme Court Weighs Legality Of Tariffs

The Supreme Court has set Friday as the date to weigh rulings in cases with national and international implications, including President Trump’s tariffs, according to a Reuters report.

At a hearing in November, Trump's tariffs drew skepticism from conservative justices, with Chief Justice John Roberts and Justice Amy Coney Barrett questioning whether the International Emergency Economic Powers Act (IEEPA) authorized the President to impose emergency tariffs.

Chief Justice Roberts also said that Congress has the “core power” when it comes to tax regulation, while rejecting the Trump administration’s claim that tariffs are not taxes.

Earlier this week, President Trump stated that the U.S. will soon receive more than $600 billion in tariffs. He called the upcoming Supreme Court’s tariff decision “one of the most important ever” in the apex court’s history.

Meanwhile, U.S. equities declined in Thursday’s pre-market trade. At the time of writing, the SPDR S&P 500 ETF (SPY), which tracks the S&P 500 index, was down by 0.23%, the Invesco QQQ Trust ETF (QQQ) fell 0.3%, while the SPDR Dow Jones Industrial Average ETF Trust (DIA) declined 0.39%. Retail sentiment around the S&P 500 ETF on Stocktwits was in the ‘bullish’ territory.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Brian_Armstrong_Coinbase_60d65adb96.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_moderna_logo_resized_c72083ff97.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2237640344_jpg_bc97a7240c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2245685477_jpg_ce08eb96cb.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2215875671_jpg_b63edc641f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)