Advertisement|Remove ads.

Trump Says US Will Soon Receive More Than $600 Billion In Tariffs Ahead Of Supreme Court Verdict

- President Trump previously warned that an adverse ruling against tariffs could leave the U.S. “financially defenseless.”

- During a November hearing, the Trump administration faced skepticism from conservative justices, with the legality of its tariff policy questioned.

- Treasury Secretary Scott Bessent stated in a Fox Business interview last month that he expects the ruling to come in January.

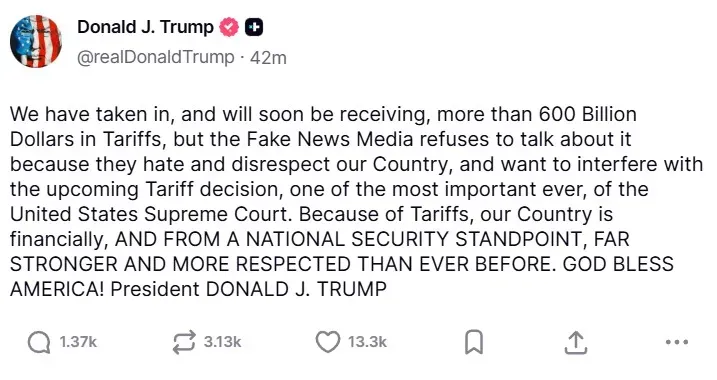

U.S. President Donald Trump stated on Monday that the United States will soon receive more than $600 billion in tariffs.

“We have taken in, and will soon be receiving, more than 600 Billion Dollars in Tariffs, but the Fake News Media refuses to talk about it because they hate and disrespect our Country, and want to interfere with the upcoming Tariff decision,” President Trump said in a post on Truth Social.

He called the upcoming Supreme Court’s tariff decision “one of the most important ever” in the apex court’s history.

When Is The Tariff Verdict Due?

The Supreme Court is expected to rule on tariffs in the coming weeks. Treasury Secretary Scott Bessent stated in a Fox Business interview last month that he expects the ruling to come in January.

During a November hearing, the Trump administration faced skepticism from conservative justices, with the legality of its tariff policy questioned. Justice Neil Gorsuch, one of the six conservative members on the court, asked if there is a practical way for Congress to get back its power to regulate taxes.

“What happens when the president simply vetoes legislation to take these powers back?” Gorsuch asked, according to a CNBC report.

Trump’s Warning

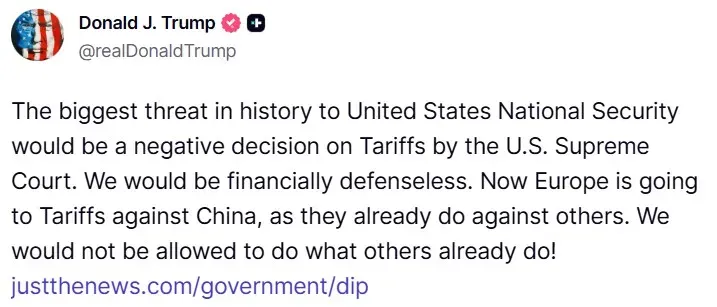

President Trump previously warned that an adverse ruling against tariffs could leave the U.S. “financially defenseless.”

“The biggest threat in history to United States National Security would be a negative decision on Tariffs by the U.S. Supreme Court,” he said in a post on Truth Social.

Meanwhile, U.S. equities gained in Monday morning’s trade. At the time of writing, the SPDR S&P 500 ETF (SPY), which tracks the S&P 500 index, was up 0.81%, the Invesco QQQ Trust ETF (QQQ) rose 1.03%, while the SPDR Dow Jones Industrial Average ETF Trust (DIA) edged up 1.57%. Retail sentiment around the S&P 500 ETF on Stocktwits was in the ‘bullish’ territory.

The iShares 20+ Year Treasury Bond ETF (TLT) was up 0.51% at the time of writing, while the iShares 7-10 Year Treasury Bond ETF (IEF) rose 0.29%.

Also See: Why Is DVLT Stock Gaining Today?

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233918556_jpg_1c5248e175.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_strait_of_hormuz_jpg_456f2fb6d3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259655311_jpg_20124bbeb9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_uniqure_jpg_33b6552285.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Sharp_Link_Gaming_jpg_60ce5684e3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_new_york_stock_exchange_jpg_e1f85c0d8c.webp)