Advertisement|Remove ads.

Williams-Sonoma Maintains Annual Forecast After Strong Q1: Retail Investor Upbeat

Williams-Sonoma (WSM) delivered better-than-expected first-quarter results and kept its full-year forecast, allaying investor fears of an all-out slump in the retail sector.

The quarterly report from the home improvement products retailer underscores that some firms are managing to absorb the tariff headwinds for now.

As the Trump administration continues to engage with multiple countries, expectations are building for a potential softening of trade policy.

“There is no doubt that existing macroeconomic and geopolitical uncertainties are a focal point for the market," CEO Laura Alber said in a statement.

"But volatility is not new in our industry, and we are confident in our ability to adapt and navigate whatever lies ahead."

Williams-Sonoma continues to anticipate a 1.5% decline to a 1.5% growth in net revenue and flat to up to 3% comparable sales for fiscal 2025.

On the analyst call, management indicated that it saw positive shopping trends despite consumers being distracted by tariffs and no material improvement in the housing market.

It also said the company is working to reorganize its sourcing and is considering hiking prices on some products.

In the first quarter, the company's adjusted profit dropped to $1.85 per share from $1.99 a year earlier, but topped the $1.73 analyst estimate from FactSet.

Net revenue rose to $1.73 billion from $1.66 billion, also above the expectation of $1.67 billion.

Shares of the company, however, dropped 4.5% on Thursday.

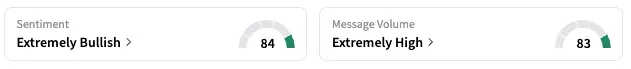

On Stocktwits, the retail sentiment rose to 'extremely bullish' from 'bullish.'

However, posts were largely negative, with users expressing a dire outlook for expensive furniture sales and CEO Alber's poor showing.

Williams-Sonoma stock is down 13.4% this year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2248926041_jpg_87d77606e2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Rare_Earth_resized_jpg_e635892f59.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_crypto_atm_OG_jpg_ab7e4567eb.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_btc_bear_crash_93b71a2ed3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_global_e_online_jpg_d113293502.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2210782299_jpg_f1c47d74a6.webp)