Advertisement|Remove ads.

Wingstop Soars 27% On Upgraded Growth Outlook, Retail Turns Extremely Bullish

Wingstop (WING) shares jumped over 27% during midday trading on Wednesday after the restaurant operator updated its full-year global unit growth forecast on the back of steady demand at its U.S. and international stores.

The company executives on a post-earnings call said the updated forecast implies net new restaurants between 435 and 460 globally. It had previously forecast a 16% to 17% unit growth.

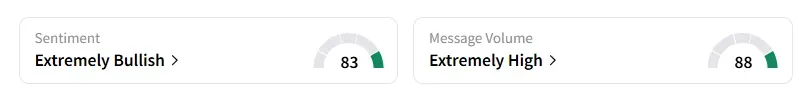

Retail sentiment on the stock improved to ‘extremely bullish’ territory, compared to ‘bearish’ a day ago, with chatter at ‘extremely high’ levels, according to data from Stocktwits.

Shares of Wingstop traded at $369.44 compared to Tuesday’s close of $290.30.

Stifel raised its price target on Wingstop to $405 from $350 and maintained a ‘Buy’ rating, according to TheFly. Stifel analyst Chris O'Cull said the brokerage was "encouraged" with management's update on key initiatives.

He added that Stifel believes visibility to improving comparable performance is "relatively high" given the ongoing Smart Kitchen rollout and continued progress on digital initiatives.

“The Wingstop Smart Kitchen is live in 1,000 restaurants across the U.S., and we are on track for a full system implementation by year-end,” CEO Michael Skipworth said.

The company’s second-quarter total revenue increased 12% to $174.3 million, compared with Wall Street expectations of $173.54 million, according to data from Fiscal AI. Its adjusted earnings per share of $1 beat estimates of $0.86.

Wingstop stock has jumped 30% so far this year and has lost 1.4% of its value in the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Also See: Etsy CFO Says Shoppers Are ‘Slightly Better,’ Retail Traders Respond With Roaring Optimism

/filters:format(webp)https://news.stocktwits-cdn.com/large_capricor_jpg_9f4f8ab098.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Robinhood_jpg_ffd49b668a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_donald_trump_crypto_atm_OG_jpg_5c3f726c93.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2236469013_jpg_0a72164947.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_tesla_cybertruck_resized_7ce9ec6562.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_ethereum_OG_jpg_57ba235889.webp)