Advertisement|Remove ads.

Winklevoss’ Crypto Exchange Gemini Rakes In $425M In IPO Proceeds — Retail Eyes The Moon

Gemini Space Station, the cryptocurrency exchange led by the Winklevoss twins, raised $425 million in an upsized initial public offering ahead of its debut on Friday.

The company priced its IPO at $28 per share, which exceeded the $24-$26 price range previously communicated by the company. Gemini and some of its shareholders sold 15.2 million shares, as per a regulatory filing, less than the 16.7 million it intended to offer earlier.

Gemini expects to list on the Nasdaq under the ticker symbol "GEMI". Goldman Sachs and Citigroup are the lead bookrunners of the IPO. The IPO implies a valuation of $3.3 billion considering its outstanding shares.

Earlier this week, the company secured a $50 million strategic investment from Nasdaq — part of a partnership that will provide Nasdaq's clients with access to Gemini's custody and staking services. Additionally, Gemini's institutional clients will be able to utilize Nasdaq’s Calypso platform to manage and track trading collateral.

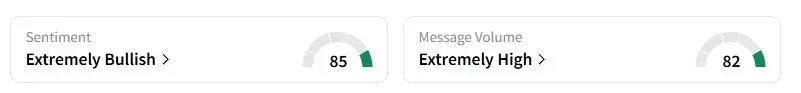

Retail sentiment on Stocktwits about Gemini was in the ‘extremely bullish’ territory at the time of writing. The stock has already gained over 1,100 followers on Stocktwits.

According to data provider Kaiko, Gemini, founded in 2014, is among the biggest U.S. crypto trading platforms by trading volume. It holds $21 billion in assets and has processed $285 billion in lifetime trading volume.

An increasing number of crypto-linked companies have reportedly been considering going public, following President Donald Trump’s second term in office, which has led to a more favorable regulatory stance from the authorities.

“IPO of the year! Let it fly higher than a Space Station!” One user said.

Gemini will be one of the four big-ticket listings on Friday, which include Blackstone Inc.-backed engineering company Legence Corp, Black Rock Coffee Bar, and software company Via Transportation.

Also See: Oil Slips As Investor Concerns Grow Around US Economy

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2212184506_jpg_fda8936683.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Novo_Nordisk_jpg_96dd19f953.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1485519874_1_jpg_82b28a6517.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_Red_OG_jpg_d64521f99a.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_crowdstrike_resized_jpg_ae45d5de0e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2234227546_jpg_b7fa546ca4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)