Advertisement|Remove ads.

Winklevoss’ Gemini Raises IPO Offering Size After Securing Nasdaq Deal

Gemini Space Station, the crypto exchange headed by the billionaire Winklevoss twins, raised the marketed price range of its initial public offering and set its sights at a valuation of $3.1 billion.

The cryptocurrency firm plans to raise approximately $433 million from its IPO and has priced its shares between $24 and $26, compared with the previous range of $17 to $19, according to a regulatory filing. As per its outstanding shares, the company will have a valuation of $3.1 billion at the top end of the offer price range.

Gemini expects to list on the Nasdaq under the "GEMI" ticker symbol and plans to sell $16.7 million shares in the offering. Goldman Sachs and Citigroup are the lead bookrunners of the IPO.

The updated offer price follows the company's securing of $50 million from Nasdaq as a strategic investment. The investment is part of a partnership, which will provide Nasdaq's clients access to Gemini's custody and staking services, and Gemini's institutional clients will be able to use Nasdaq’s Calypso platform to manage and track trading collateral.

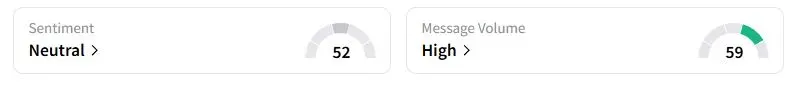

Retail sentiment on Stocktwits about Gemini was in the ‘neutral’ territory at the time of writing. The stock has already gained around 600 followers.

According to data provider Kaiko, Gemini, founded in 2014, is among the biggest U.S. crypto trading platforms by trading volume. It holds $21 billion in assets and has processed $285 billion in lifetime trading volume.

“I have a feeling twins holding back one more big news/development PR until after ipo launch,” one user said.

An increasing number of crypto-linked companies have reportedly been considering going public, following President Donald Trump’s second term in office, which has led to a more favorable regulatory stance from the authorities.

Peter Thiel-backed crypto exchange Bullish (BLSH) and stablecoin issuer Circle Internet are the two most recent entrants. Bullish stock has gained over 45% since its debut.

Also See: Why Is QMMM Stock Plunging 60% In Premarket Trading?

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2239226376_jpg_c72fd10c8b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_App_Lovin_jpg_42d40549b1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_US_economy_representative_image_jpg_88c3aa4736.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_canada_jpg_0f117ea8e7.webp)