Advertisement|Remove ads.

WK Kellogg Stock Surges After Q4 Earnings Beat: Retail Sentiment Brightens

Shares of WK Kellogg Co ($KLG) surged 3.92% on Tuesday after the breakfast cereal maker beat Wall Street expectations on earnings, lifting retail sentiment.

WK Kellogg posted $0.42 in earnings per share, above the $0.26 quoted by Wall Street analysts. Its revenues stood at $640 million down 2% year-over-year, missing estimates of $645.18 million, according to Stocktwits data.

The fourth quarter net sales decline was due to the ongoing challenging business environment and the unfavorable impact of foreign exchange translation, resulting from the weakening of the Canadian Dollar.

Its Q4 net income was $19 million, up 26.7% year-over-year. The increase reflected improved productivity and reduced waste within its supply chain operations.

For 2025, the company expects organic net sales to decline by 1% while its adjusted earnings before interest, taxes, depreciation and amortization are expected to grow between 4% and 6%.

“I am pleased with our overall 2024 financial results, including delivering adjusted EBITDA growth above the top end of our guidance range,” said Gary Pilnick, chairman and CEO of WK Kellogg. “The team has done a great job executing on our plan, advancing our strategic priorities, and building for the future, which gives us confidence in our ability to deliver on our 2025 commitments.”

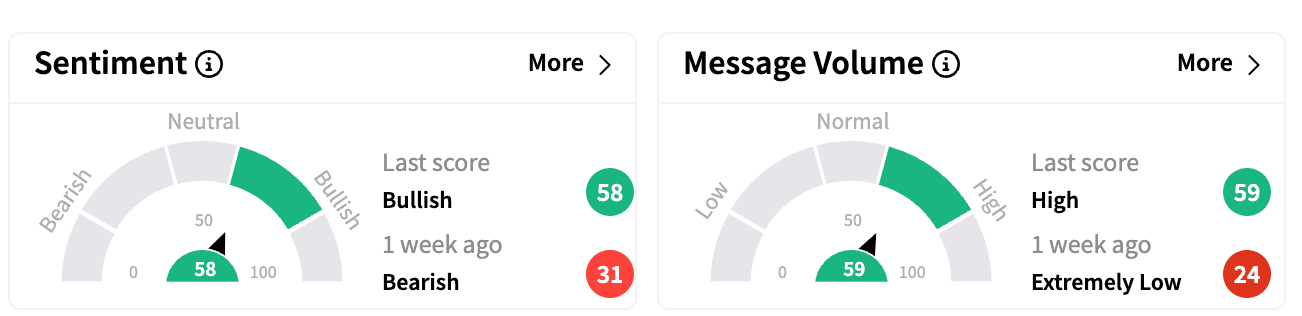

Sentiment on Stocktwits improved to ‘bullish’ from ‘bearish' last week. Message volumes also inched up to the ‘high’ zone from ‘extremely low.’

WK Kellogg’s board approved an increase in its quarterly dividend to $0.165 per share on the common stock from the prior quarterly dividend of $0.16 per share. The quarterly dividend is payable on March 14, 2025, to shareowners of record at the close of business on February 28, 2025. The ex-dividend date is February 28, 2025.

WK Kellogg’s brands include Kellogg's Frosted Flakes, Rice Krispies, Froot Loops, and Bear Naked.

WK Kellogg’s stock is down 5.78% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2203138957_jpg_dd735f9905.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_tim_cook_OG_jpg_08b852f801.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Coinbase_c429427aa1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230437216_jpg_6078a75ee4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_etoro_logo_resized_jpg_e33db568c2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_jamieson_greer_jpg_e66ba6dd7a.webp)