Advertisement|Remove ads.

Workday Stock Is Up 9% Pre-Market Today And There’s A Wall Street Angle – More Details Inside

Workday (WDAY) shares climbed over 9% in premarket trading on Wednesday after multiple brokerages upgraded the stock, citing the company's potential for accelerated growth.

Piper Sandler upgraded Workday to ‘Neutral’ from ‘Underweight’ with a price target of $235, up from $220, according to TheFly. The firm is seeing early signs that Workday's efforts to increase relevance in artificial intelligence have accelerated.

On Tuesday, Workday announced that it has entered into a definitive agreement to acquire Sana, an AI company, for approximately $1.1 billion. Workday said that since Sana’s founding in 2016, it has been at the forefront of AI for work, developing intuitive tools.

The retail user message count around Workday jumped 320% in the last 24 hours on Stocktwits. On Tuesday, Elliott Investment Management announced that it had built up a stake worth more than $2 billion in Workday, making it the company's fourth-largest institutional investor.

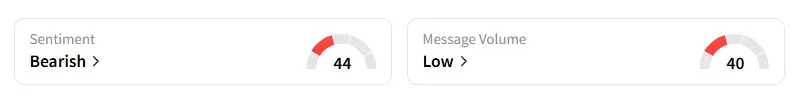

Retail sentiment on Workday remained unchanged in the ‘bearish’ territory, with message volumes at ‘low’ levels, according to data from Stocktwits.

Piper Sandler noted that the company's organic and inorganic initiatives will likely take time to catalyze a growth rebound.

Guggenheim upgraded Workday to ‘Buy’ from ‘Neutral’ with a $285 price target. When the environment improves, Workday will be well-positioned to accelerate growth, the firm added.

The firm noted that it expects Workday to grow by double digits for the foreseeable future, even if the environment remains relatively stagnant. Guggenheim says Workday is a better-positioned company today than it was a few years ago.

Shares of Workday have declined 15% this year and nearly 12% over the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_eli_lilly_logo_resized_9e8a8a2333.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_celsiusholdings_resized_jpg_5617397fa8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Ethereum_OG_jpg_d3e6e5843b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2226817028_jpg_d2fd9156db.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_elerian_resized_jpg_49303b41ee.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_netflix_paramount_warner_bros_jpg_c959c8a9e4.webp)