Advertisement|Remove ads.

Yes Bank eyes rating upgrade after SMBC deal, expects double-digit loan growth

On succession planning, Yes Bank Managing Director and CEO Prashant Kumar said, “This is something which all of us together would take a call on at the appropriate time. We will disclose it in the markets when decided.”

Yes Bank Managing Director and CEO Prashant Kumar said the lender expects a further credit rating upgrade in the coming quarters following the completion of its deal with Sumitomo Mitsui Banking Corporation (SMBC).

“All our ratings have been upgraded before the SMBC transaction,” Kumar said. “After the SMBC transaction, we would be expecting a further rating upgrade in the next one or two quarters.”

The private lender reported an 18.4% year-on-year (YoY) rise in net profit for the July-September 2025 quarter, supported by steady interest income and stable asset quality. Kumar said the SMBC partnership is opening new business avenues. “This deal is giving us a lot of opportunities - not only from the rating perspective, but also in terms of engaging with corporates, meeting their cash management and trade requirements, and taking care of employees,” he said.

On profitability, Kumar reiterated that the bank aims to reach a 1% return on assets (ROA) by the fiscal year 2026-27 (FY27), adding that the SMBC deal “would definitely accelerate that pace.”

Kumar said the bank has managed to lower its cost of deposits by 20 basis points and cost of funds by 30 basis points, aided by a strong rise in current account/savings account (CASA) deposits. “Our CASA growth is almost double the growth of overall deposits,” he said. For the past six quarters, the bank has been following a cautious approach toward profitable growth across both assets and liabilities, he added.

He also highlighted progress on the Rural Infrastructure Development Fund (RIDF), which had earlier constrained returns. “We were having a RIDF exposure of more than 10% of total assets - that has already come down to 7.8%. Next year, we’ll see a repayment of over ₹9,000 crore,” Kumar said. “The delta between what we get on RIDF and what we can alternatively earn is around 4%, which will help improve margins.”

Also Read | Yes Bank to leverage SMBC partnership, targets 10-12% credit growth: CEO Prashant Kumar

Kumar said the bank expects margin expansion driven by CASA growth, repricing of deposits, and lower RIDF exposure. “As of now, I am not putting a number because you can’t rule out a further cut on the repo rate going forward,” he said.

On loan growth, Kumar said large corporate lending grew 7.5% quarter-on-quarter (QoQ) and 14-15% YoY, while commercial banking rose 16% and retail is expected to grow above 5%. “Overall, we are aspiring for double-digit loan growth,” he said.

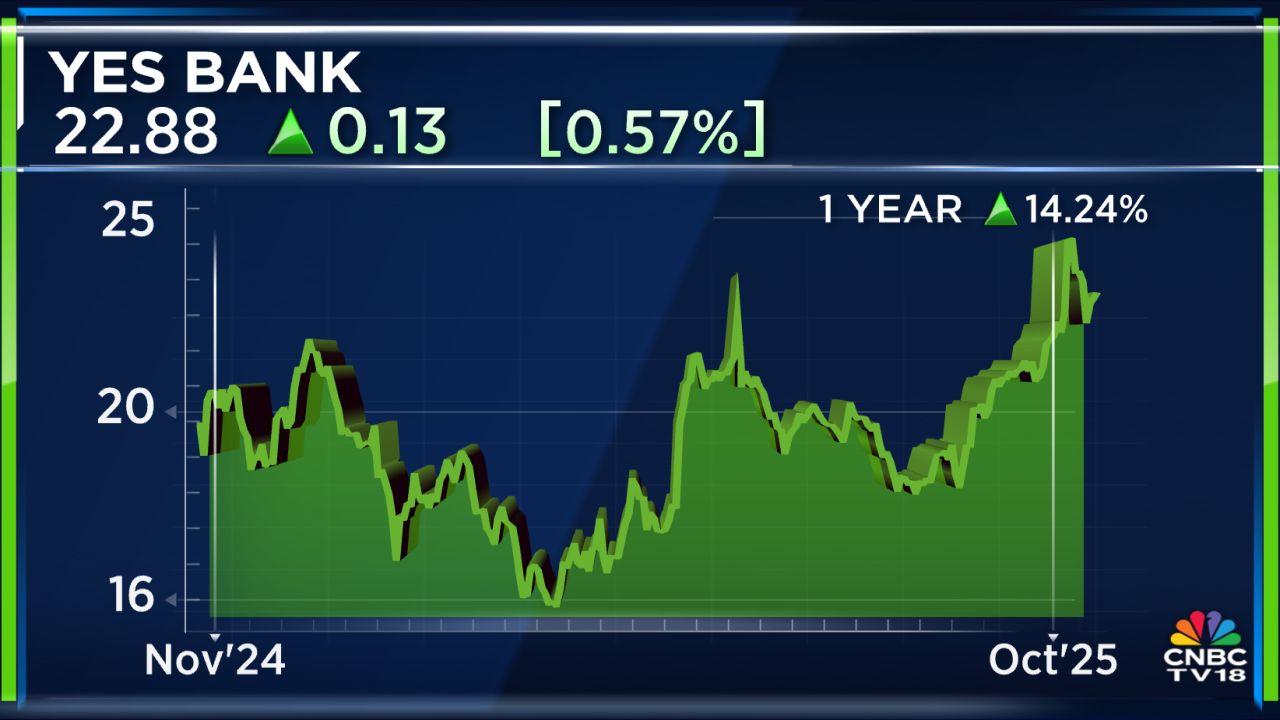

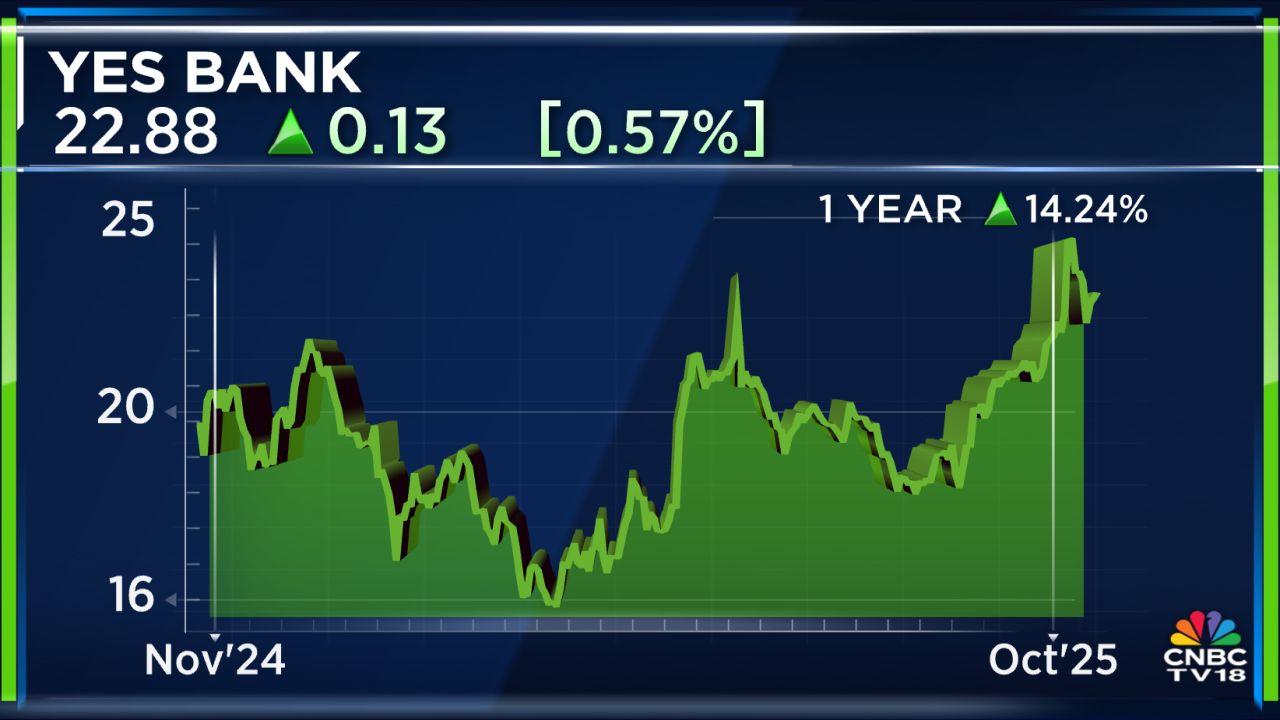

Yes Bank’s market capitalisation stands at ₹71,751 crore, with the stock gaining more than 14% over the past year.

For the full interview, watch the accompanying video

Catch all the latest updates from the stock market here

“All our ratings have been upgraded before the SMBC transaction,” Kumar said. “After the SMBC transaction, we would be expecting a further rating upgrade in the next one or two quarters.”

The private lender reported an 18.4% year-on-year (YoY) rise in net profit for the July-September 2025 quarter, supported by steady interest income and stable asset quality. Kumar said the SMBC partnership is opening new business avenues. “This deal is giving us a lot of opportunities - not only from the rating perspective, but also in terms of engaging with corporates, meeting their cash management and trade requirements, and taking care of employees,” he said.

On profitability, Kumar reiterated that the bank aims to reach a 1% return on assets (ROA) by the fiscal year 2026-27 (FY27), adding that the SMBC deal “would definitely accelerate that pace.”

Kumar said the bank has managed to lower its cost of deposits by 20 basis points and cost of funds by 30 basis points, aided by a strong rise in current account/savings account (CASA) deposits. “Our CASA growth is almost double the growth of overall deposits,” he said. For the past six quarters, the bank has been following a cautious approach toward profitable growth across both assets and liabilities, he added.

He also highlighted progress on the Rural Infrastructure Development Fund (RIDF), which had earlier constrained returns. “We were having a RIDF exposure of more than 10% of total assets - that has already come down to 7.8%. Next year, we’ll see a repayment of over ₹9,000 crore,” Kumar said. “The delta between what we get on RIDF and what we can alternatively earn is around 4%, which will help improve margins.”

Also Read | Yes Bank to leverage SMBC partnership, targets 10-12% credit growth: CEO Prashant Kumar

Kumar said the bank expects margin expansion driven by CASA growth, repricing of deposits, and lower RIDF exposure. “As of now, I am not putting a number because you can’t rule out a further cut on the repo rate going forward,” he said.

On loan growth, Kumar said large corporate lending grew 7.5% quarter-on-quarter (QoQ) and 14-15% YoY, while commercial banking rose 16% and retail is expected to grow above 5%. “Overall, we are aspiring for double-digit loan growth,” he said.

Yes Bank’s market capitalisation stands at ₹71,751 crore, with the stock gaining more than 14% over the past year.

For the full interview, watch the accompanying video

Catch all the latest updates from the stock market here

Read about our editorial guidelines and ethics policy

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_rivian_4_3_SUV_1330f80aaf.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2225995334_jpg_67de820c56.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2187726936_jpg_ca6aee809e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Door_Dash_jpg_1088720ba5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_solana_company_OG_jpg_3fbf92d9ba.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Musk_new_d87de2220e.webp)