Advertisement|Remove ads.

Lyft Stock Wins Over Wall Street And Retail With Q3 Revenue Beat And AV Alliances

Shares of Lyft, Inc. ($LYFT) shot up more than 20% pre-market Thursday, adding to previous session gains and boosting retail sentiment. The company reported third-quarter sales that beat expectations and offered an upbeat demand forecast.

For Q3, Lyft posted a net loss of $12.4 million, or $0.03 per share (which included a $36.4 million restructuring charge), in line with Wall Street estimates. Revenue rose 32% to $1.52 billion from a year earlier, better than the expected $1.44 billion.

Lyft reported record active riders of 24.4 million for the quarter, a 9% increase year-over-year, and record rides of 217 million, up 16% from a year earlier.

In Q3, Lyft said demand exceeded expectations, and added that it ended the quarter with a strong cash position of $770 million. Lyft has a long-term debt of $574 million.

The company expects full-year free cash flow to exceed $650 million and noted that it executed all parts of its strategic plan during the quarter.

It said its price lock feature performed better than expected, with driver and rider metrics hitting all-time highs.

Lyft also reported commute rides surpassing pre-pandemic levels and projected further expansion in Canada.

For FY24, the company reaffirmed mid-teens rides growth and forecasted gross bookings growth around 17%.

For Q4, it expects adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) of $100 million–$105 million and gross bookings of $4.28 billion–$4.35 billion.

The company also unveiled multiple autonomous vehicle (AV) partnerships, including alliances with Mobileye and Nexar, prior to its earnings release, driving up retail excitement.

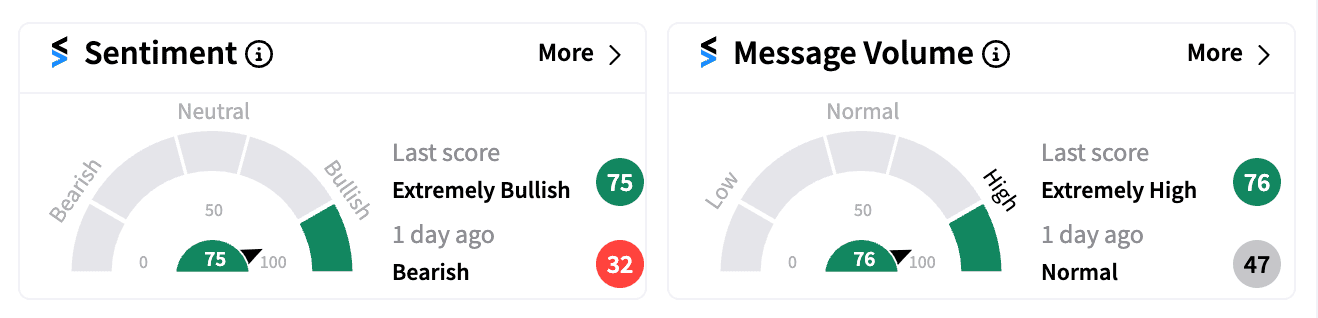

On Stocktwits, LYFT stock sentiment was ‘extremely bullish’ going into Thursday amid rising retail chatter. The ticker was among the top trending symbols as of 6:45 am ET.

One user hoped the stock “sticks to the upside” following the results, while another expected it to hit $20 by Friday.

Lyft shares are up over 4% so far this year, and if Thursday’s pre-market gains hold, the stock could be on track to hit near 6-month highs.

For updates and corrections, email newsroom@stocktwits.com

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2226079120_jpg_10ed2924af.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_OG_oct23_jpg_588046d0a9.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2239867148_jpg_8df22810c1.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227347123_jpg_b7a8c29717.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1236199359_jpg_28b0018e3a.webp)