Advertisement|Remove ads.

Prison Stocks Geo Group, Core Civic Surge To 5-Year Highs: Retail Bets Big On Trump-Driven Detention Boom

Shares of GEO Group ($GEO) and CoreCivic ($CXW) surged on Wednesday, hitting five-year highs after Donald Trump’s U.S. presidential election win fueled speculation of an impending detention boom.

Trump has vowed to enforce the largest mass deportation of undocumented immigrants in U.S. history, a policy shift that investors believe could benefit private prison operators.

As of 2:20 p.m. ET Wednesday, GEO shares had climbed more than 37%, while CXW gained over 28%, ranking among the day’s top 10 gainers across U.S. exchanges.

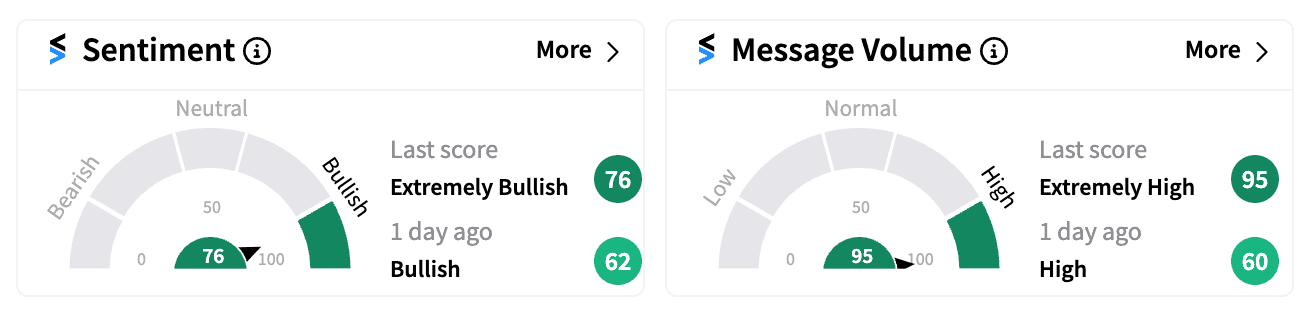

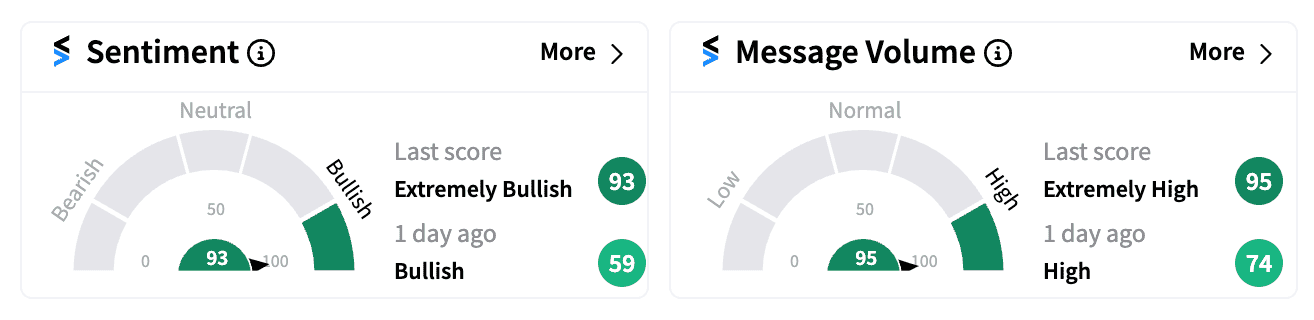

Retail sentiment on both stocks spiked to ‘extremely bullish’ on Stocktwits, with a notable increase in message volume.

GEO Group, which provides housing for U.S. Immigration and Customs Enforcement (ICE) detainees, revealed in October that ICE had exercised a five-year extension option on its 1,940-bed Adelanto ICE Processing Center in California, securing the contract through December 2029.

MarketWatch reports that according to GEO, private companies supply 90% of ICE’s detention beds, and GEO operates 42% of these facilities.

An October report by NBC News indicated that Trump’s team may pressure local law enforcement to participate in deportations by threatening to withhold federal police grants, creating additional opportunities for private detention centers to expand their services.

Both GEO and CXW are set to report third-quarter earnings on Thursday. Analysts expect GEO to post EPS of $0.24, up from $0.19 a year ago, with revenue rising to $612.63 million from $602.78 million.

CXW’s adjusted EPS is projected to decline to $0.09 from $0.12 in the prior-year quarter, with revenue slipping to $469.84 million from $483.7 million.

Year-to-date, GEO has gained over 93% in value, compared to a 21% increase for CXW.

For updates and corrections, email newsroom@stocktwits.com

Read next: US Election 2024: Trump's Triumph Lifts Bitcoin To Record High, Crypto-Linked Stocks Surge

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2224449965_jpg_7000f4499b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_trader_rise_resized_d366c3169c.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stock_chart_falling_resized_jpg_c0ce61eff2.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_charlesschwab_resized_c3011024fe.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Stellantis_jpg_b729269f9b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2167490837_jpg_471b0d5535.webp)