Advertisement|Remove ads.

Yum Brands Upgraded To 'Buy' At Goldman Sachs On Industry-Leading Growth, Digital Push

Goldman Sachs on Wednesday upgraded its rating on Yum! Brands (YUM) stock to 'Buy' from 'Neutral,' citing strong projected growth and operational efficiencies.

According to a summary of the note shared on The Fly, the investment bank said the company's growth trajectory is "best-in-class" compared to most other chains, partly driven by its high percentage of franchisee-owned stores.

The mix builds relative resilience into the business, according to the note.

Yum operates KFC, Pizza Hut, and Taco Bell.

Goldman Sachs also noted that Yum is making meaningful strides in digital integration, both across its brands and at the enterprise level, which would boost operational efficiency and sales growth.

The investment bank maintained its price target on the company's shares at $167, indicating a 16% upside from current levels.

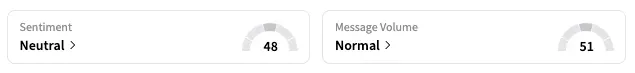

On Stocktwits, the retail sentiment for the company was 'neutral,' unchanged from a month ago.

The analyst action comes at a time when businesses face risks from an aggressive and evolving U.S. trade policy, which has dampened consumer spending to some extent.

The reported impact on the food and restaurant sector has been mixed and varied across different segments.

Yum delivered robust first-quarter results last month, noting that tariffs had only a minimal effect on its business, while its Taco Bell outlets performed exceptionally well.

It also recently announced a $2 billion investment to expand its chains in the UK and Ireland, a move that further bolstered investor confidence.

YUM shares are up 7.4% this year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2246580703_jpg_9700e1e7e8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2189643067_jpg_243b1172b6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1494564204_jpg_be6f667516.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259256580_jpg_e72ea8ddc5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_supermicro_resized_jpg_95d12828d5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_UWM_resized_f22f7e06b8.jpg)