Advertisement|Remove ads.

Zee Entertainment Shares Fall After Its Fundraising Proposal Fails Shareholder Vote: SEBI RA Sees Support In ₹120-₹130 Zone

Zee Entertainment’s stock declined in Friday’s trade after the company failed to get approval to issue fully convertible warrants to the promoter group.

Zee shares were trading down 2.6% at ₹138 in late afternoon trade.

Shareholders rejected the company’s proposal to raise ₹2,237.44 crore from promoter group entities, which would have increased promoter shareholding to 18.4%.

The special resolution, aimed at issuing fully convertible warrants to the promoter group on a preferential basis, secured only 59.51% of votes in favor, while 40.48% opposed it. As a special resolution, it required at least 75% shareholder approval to pass.

The plan was intended to strengthen Zee’s capital base for future growth initiatives. However, shareholder sentiment was divided, with some proxy advisory firms supporting the move and others opposing it due to concerns about dilution, reports said.

SEBI-registered analyst Palak Jain noted that the stock has key support in the ₹120 - ₹130 range, with immediate resistance between ₹142 and ₹155. Further movement may depend on investor sentiment and upcoming strategic updates.

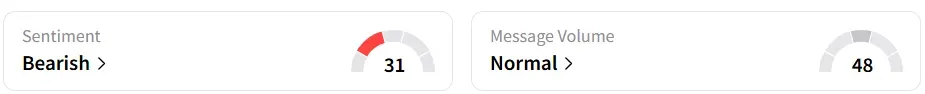

Retail sentiment remained ‘bearish’ on Stocktwits.

Year-to-date (YTD), the stock has gained 14%.

For updates and corrections, email newsroom[at]stocktwits[dot]com

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2221283194_jpg_8178c730a4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Morgan_Stanley_HQ_logo_5431c7f2ad.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1549425533_jpg_483afd6d69.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_down_resized_901c19c371.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2235778544_jpg_2b7ceca102.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_hawaiian_electric_resized_4b766fd741.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)