Advertisement|Remove ads.

Zeta Global Draws Analyst Confidence With $325M Marigold Asset Deal: Retail Echoes Confidence

Zeta Global Holdings Corp. (ZETA) received a boost from Canaccord, which increased its price target on the marketing technology company’s stock to $30, up from a previous forecast of $28.

The firm reaffirmed its ‘Buy’ rating, signalling continued confidence in Zeta's growth strategy, according to Fiscal AI data.

Canaccord’s latest assessment follows Zeta’s recent acquisition of key enterprise software assets from Marigold, potentially totaling $325 million in a combination of cash and stock. The transaction is valued at under two times enterprise value to revenue and under 10 times enterprise value to EBITDA (earnings before interest, taxes, depreciation, and amortization) based on the projected contribution in calendar year 2026.

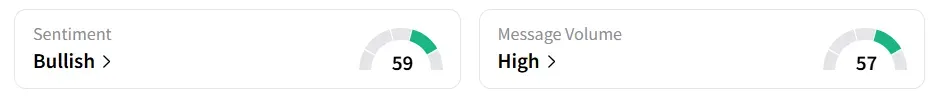

Zeta Global stock inched 0.4% lower on Wednesday afternoon. On Stocktwits, retail sentiment around the stock jumped to ‘bullish’ from ‘bearish’ territory the previous day. Message volume improved to ‘high’ from ‘low’ levels in 24 hours.

The stock experienced a 440% increase in user message count over a 24-hour period as of Wednesday morning. A bullish Stocktwits user expressed optimism about the acquisition.

The firm emphasized the strategic logic behind the acquisition, suggesting it strengthens Zeta's enterprise capabilities and views the transaction as a solid fit.

The acquisition is expected to help Zeta strengthen its foothold in the EMEA region while opening new opportunities across the Asia-Pacific market. Zeta expects the transaction to contribute positively to its adjusted EBITDA and free cash flow from the first year.

Zeta Global stock has gained over 9% year-to-date and lost over 33% in the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2260447662_jpg_cd246b74f6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2254924116_jpg_d54ffea07e.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_US_stocks_3e2253bcca.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Revised_Profile_JPG_0e0afdf5e2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2228900989_jpg_e94daec744.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1445160636_jpg_9759816169.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_Red_OG_jpg_d64521f99a.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)