Advertisement|Remove ads.

Zimmer Biomet Stock Plummets On 2025 Earnings Outlook Downgrade: But Retail’s Bullish

Shares of Zimmer Biomet Holdings, Inc. (ZBH) declined 10% on Monday after the company lowered its full-year earnings guidance over tariff concerns.

Zimmer now expects 2025 adjusted profit per share in the range of $7.90 to $8.10, compared with its prior forecast of $8.15 to $8.35 per share. The new guidance, it said, includes the acquisition of Paragon 28, Inc., currency expectations, and the impact of current tariff proposals.

Zimmer Biomet completed the acquisition of Paragon 28 in April. Paragon 28 is a medical device company focused exclusively on the fast-growing foot and ankle orthopedic space.

The medical technology company reported first-quarter net sales of $1.909 billion, an increase of 1.1% over the prior year, and above an analyst estimate of $1.895 billion, as per Finchat data.

While sales within the U.S. rose 1.3% to $1.11 billion, sales in international markets jumped 0.7% to $795.5 million.

During the quarter, the rise in sales across the knees, hips, sports medicine, extremities, trauma, craniomaxillofacial, and thoracic (S.E.T) product categories helped offset a near 5% decline in net sales from the company’s technology and data, bone cement, and surgical product categories.

Meanwhile, adjusted diluted earnings per share fell to $1.81 in the quarter, down from $1.94 in the corresponding quarter of 2024, but above an analyst estimate of $1.77.

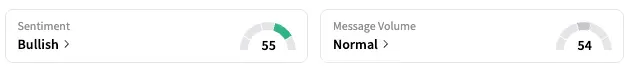

On Stocktwits, retail sentiment around Zimmer Biomet jumped from ‘bearish’ to ‘bullish’ over the past 24 hours while message volume rose from ‘low’ to ‘normal’ levels.

ZBH stock is down by about 12% this year and 24% over the past 12 months.

Also See: Tesla Sales In Spain Plummet 36% Even As EV Sales Accelerate

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2240656304_jpg_754321c130.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_pharma_stock_jpg_490939e580.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_down_resized_901c19c371.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ardelyx_jpg_488a3f8312.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2252194207_jpg_9605cd50d5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2247687123_1_jpg_5a8fc404b7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)