Advertisement|Remove ads.

AST SpaceMobile Stock Rockets After Confirmation Of Launch Date For BlueBird Satellites: Retail Rides Along

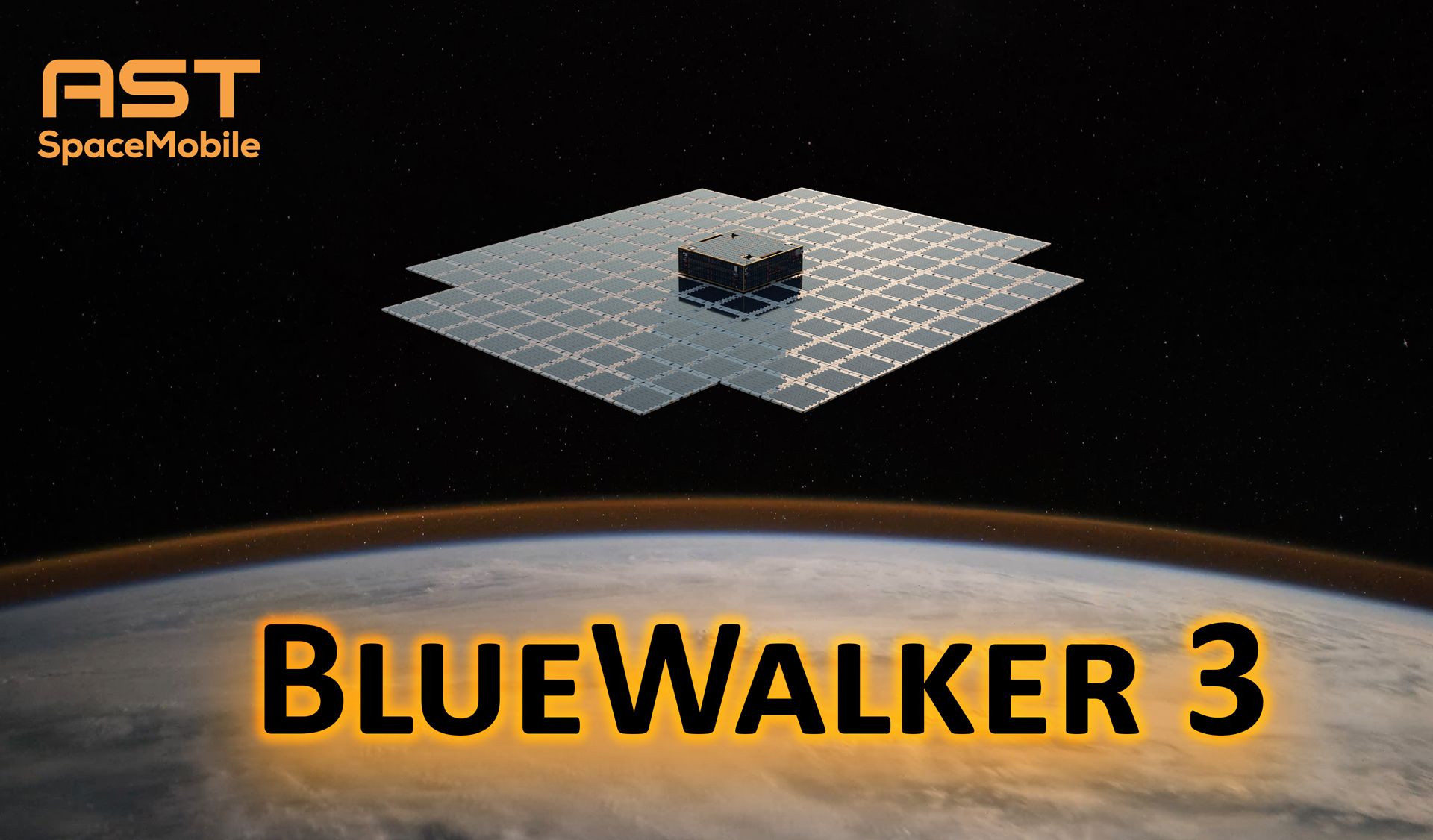

Shares of AST SpaceMobile Inc. (ASTS) surged over 21% on Wednesday after the space communications start-up confirmed the launch date for its first five commercial satellites, known as BlueBird.

Scheduled for lift-off on or after Sept. 12 from Cape Canaveral, Florida, these satellites are set to provide non-continuous cellular broadband service across the United States and select global markets.

According to the company, the BlueBird satellites will operate in low Earth orbit and use premium low-band spectrum to deliver broadband services. They will initially support beta test users for AT&T and Verizon, targeting near-complete nationwide coverage in the U.S. through over 5,600 coverage cells.

AST SpaceMobile’s momentum also gained from Wall Street’s positive outlook. Deutsche Bank analyst Bryan Kraft raised his price target on AST SpaceMobile shares from $22 to $63, reflecting a 77% upside from current trading levels, while maintaining a Buy rating.

Kraft noted that the previous valuation model had undervalued AST's growth potential, and adjustments were necessary given AST's progress in validating its technology and formalizing strategic partnerships. The firm cited the company's progress in constructing and ground-testing its satellites as a key driver behind the revaluation.

In May, AST SpaceMobile shares had witnessed a spike following the announcement of a strategic partnership with Verizon Communications Inc. (VZ).

Retail investors on Stocktwits have taken notice, making ASTS one of the top 10 most active symbols on Wednesday.

Many users highlighted the Deutsche Bank price target upgrade and its forecast for substantial earnings before interest, tax, depreciation, and amortization (EBITDA) growth, with expectations for free cash flow turning positive by 2027, when the company is expected to have a fleet of 95 satellites.

ASTS shares have skyrocketed 644% this year, vastly outperforming broader market indices like the S&P 500 and Nasdaq, as investors continue to bet on the company’s disruptive potential in the space communications sector.

Read Next: ZScaler Stock Tanks, So Does Retail Sentiment On Dim Earnings Outlook

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250240977_jpg_5b777d96ef.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2206295220_jpg_1057588802.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2247614893_jpg_e1dcf2d2f6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Sound_Hound_jpg_7961ee756a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2191702229_jpg_e9b50f268b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)