Advertisement|Remove ads.

Boeing Stock Rebounds Pre-Market On Tentative Labor Deal: Retail Investors In Wait-And-See Mode

Boeing Co. (BA) shares jumped over 4% pre-market on Monday after the aerospace giant reached a tentative labor agreement with the International Association of Machinists and Aerospace Workers (IAM), just days before a costly strike could have disrupted its main factories.

The deal, which still needs to be approved by the union's 33,000 members, includes a 25% raise over four years, along with improvements to healthcare and retirement benefits. It also secures a commitment from Boeing to build its next airplane in the Pacific Northwest.

The union hailed the agreement as the best contract it has ever negotiated, marking an early win for Boeing’s new CEO Kelly Ortberg, who has the daunting task of steering the struggling planemaker back on track.

However, with the final vote scheduled for Sept. 12, it's not a done deal yet, and the possibility of a strike looms if members reject the proposal.

JPMorgan analysts called the proposed deal a "good outcome" that avoids a potentially prolonged strike that Boeing cannot afford. The firm noted that the financial terms seem balanced.

However, it warned that the rank-and-file union members might still vote against the deal, prompting Boeing to make further concessions. JPMorgan maintains an ‘Overweight’ rating on Boeing, with a price target of $235.

Bank of America echoed similar sentiments, highlighting the weekend's dual wins for Boeing: reaching a tentative labor agreement and successfully returning its Starliner spacecraft to Earth, albeit without astronauts.

BofA views both events as significant positives that reduce risks for Boeing and CEO Kelly Ortberg. However, it cautions that the Sept. 12 vote will be a crucial test, with union members still able to reject the proposal. BofA retains a ‘Neutral’ rating and a $200 price target on Boeing shares.

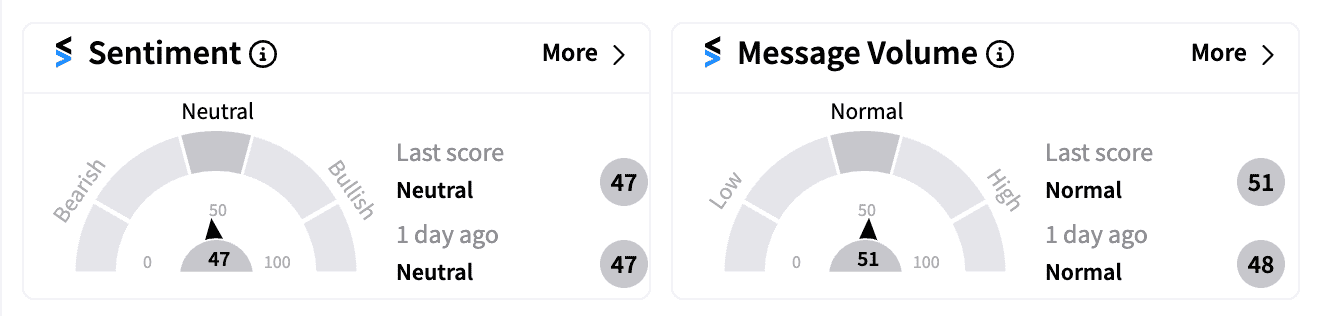

On Stocktwits, where Boeing has over 185,000 followers, sentiment remained ‘neutral’ (47/100) with message volume at ‘normal’ levels.

One skeptical user posted, “Taking away bonuses, increasing medical coverage costs, and the raise doesn't keep up with inflation from the last 10 years…Deal is not done.”

Another user was more optimistic about Boeing’s new leadership, writing, “The new CEO Kelly Ortberg seems to find ways to make it happen.”

Boeing’s stock has slumped more than 37% this year, reflecting ongoing issues including the fallout from fatal crashes linked to design flaws, accusations of prioritizing profits over safety, declining aircraft sales, and rising debt.

Read Next: Apple Stock Edges Up Pre-Market Ahead Of iPhone 16 Launch: Retail Isn’t Fully Sold On The Hype Yet

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2199618807_jpg_0e9f26c6c5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262651778_jpg_54075aa1d9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2246580703_jpg_9700e1e7e8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2189643067_jpg_243b1172b6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1494564204_jpg_be6f667516.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259256580_jpg_e72ea8ddc5.webp)