Advertisement|Remove ads.

Dollar Tree Stock Plunges On Disappointing Earnings And Outlook: Retail Turns More Bearish

Shares of Dollar Tree Inc. (DLTR) dropped over 6% in pre-market trading on Wednesday after the discount retailer reported weaker-than-expected Q2 earnings and slashed its full-year forecast, further dampening retail sentiment.

Dollar Tree reported Q2 adjusted earnings per share (EPS) of $0.67, missing Wall Street’s estimate of $1.04, while sales came in at $7.38 billion, below the expected $7.49 billion.

The company now expects FY24 sales between $30.60 billion and $30.90 billion, down from its prior forecast of $31 billion to $32 billion.

Annual adjusted EPS is projected to range from $5.20 to $5.60, a significant cut from the earlier forecast of $6.50 to $7.00 per share.

CFO Jeff Davis noted that much of the earnings shortfall was due to an adjustment in general liability accrual, alongside softer comparable sales “which reflected the increasing effect of macro pressures on the purchasing behavior of Dollar Tree's middle- and higher-income customers.”

As part of its portfolio optimization, Dollar Tree has closed approximately 655 stores and plans to shutter 45 more by the end of the fiscal year.

Discount retailers are struggling to attract price-sensitive shoppers in a high-inflation environment. Peer Dollar General (DG) last week also cut its annual forecasts due to disappointing quarterly sales and signs of strained spending among consumers and households.

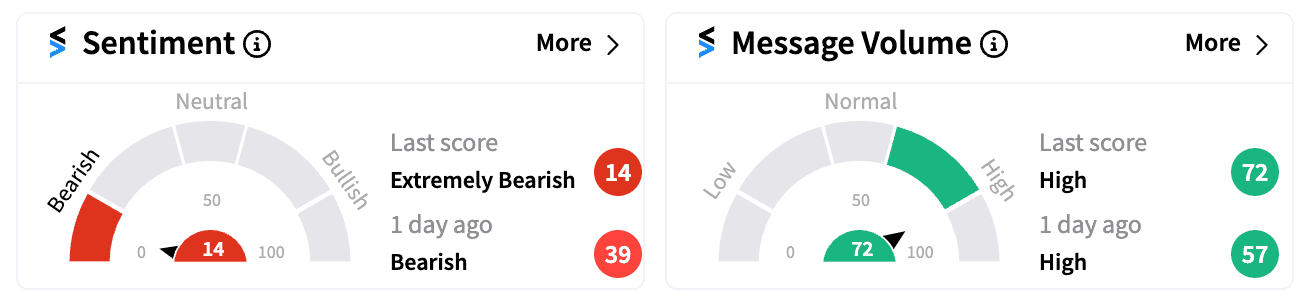

Sentiment towards Dollar Tree on Stocktwits has turned “extremely bearish,” with the score (14/100) dropping to its second-lowest level this year.

One bearish user remarked, “$DLTR Earnings report doesn’t seem to look good. Would be wise to take the profit while it’s green in RH right now imo.”

Another expressed frustration over lackluster same-store sales growth, with Dollar Tree reporting only 1.3% growth while Family Dollar locations saw a 0.1% fall.

Dollar Tree’s stock has lost more than 42% this year, underscoring the steep challenges facing discount retailers as they grapple with changing consumer behavior and persistent economic pressures.

Though inflation has moderated a bit, the start of the rate cut cycle in September should provide much-needed relief to retailers like Dollar Tree and Dollar General.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1494564204_jpg_be6f667516.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259256580_jpg_e72ea8ddc5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_supermicro_resized_jpg_95d12828d5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_UWM_resized_f22f7e06b8.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2229918735_jpg_e905cbd5e3.webp)