Advertisement. Remove ads.

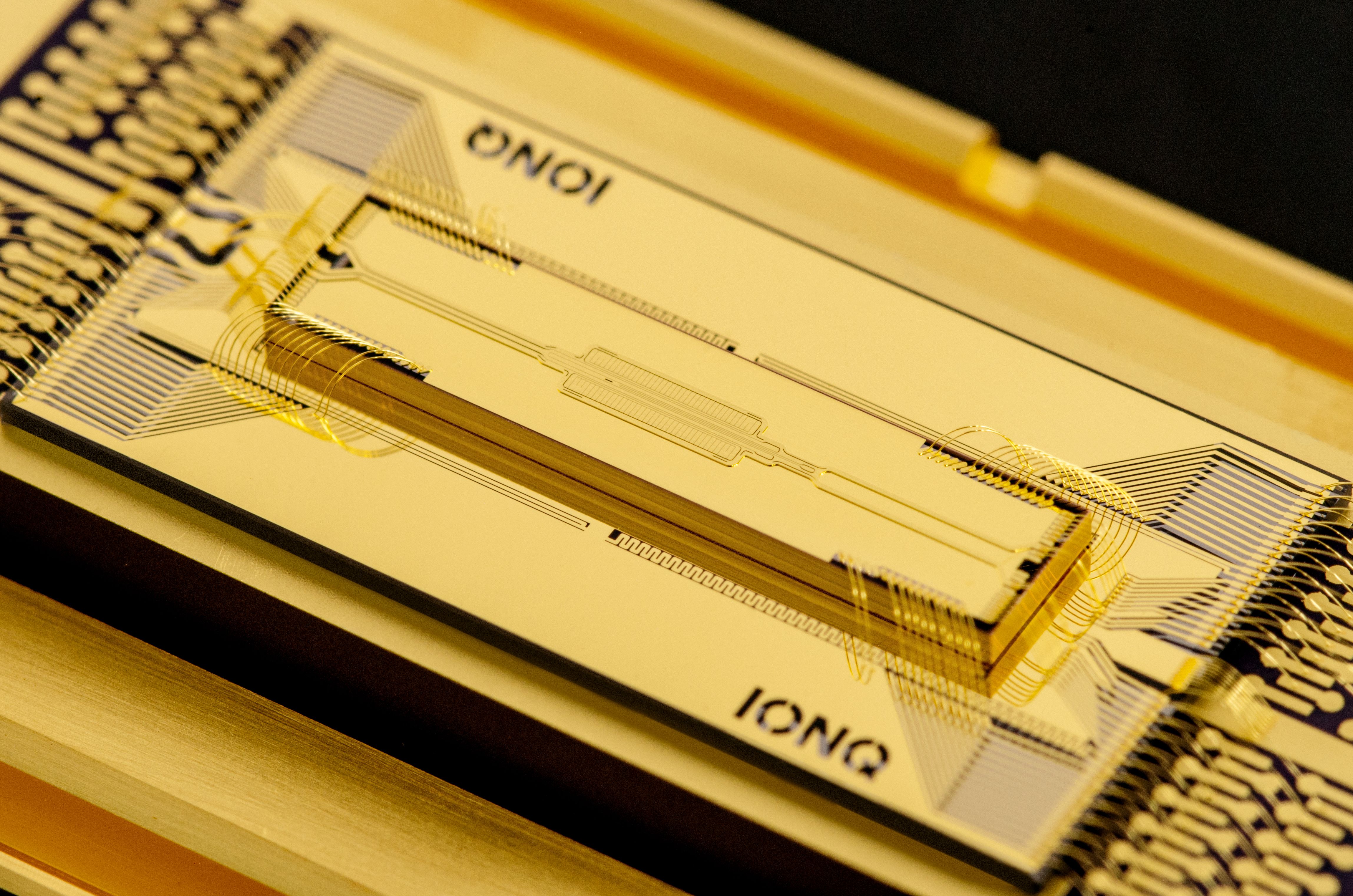

IonQ Stock Soars 22% After Multi-million Dollar Deal With US Air Force: Retail Sentiment Hits One-Year High

Shares of quantum computing firm IonQ Inc (IONQ) soared over 22% on Friday after it announced the signing of a $54.5 million contract with the United States Air Force Research Lab (AFRL).

IonQ said the focus of the contract, which will be delivered over four years, is to design, develop, and deliver technology and hardware that enables the scaling, networking, and deployability of quantum systems.

Congresswoman Elise Stafanik said the latest collaboration “is bringing new quantum computing jobs to Rome, and the work done there will ensure the U.S. remains the global defense leader.”

IonQ has announced $72.8 million in bookings since the beginning of the year and this appears to have reinforced its confidence in meeting or exceeding its bookings guidance of $75-95 million for the year.

The company claims to have seen traction and growth not just in government, but with global enterprise customers and leading academic institutions. This is evident from the number of deals it signed in recent times.

Last month, the firm said it was selected by the Applied Research Laboratory for Intelligence and Security (ARLIS) for a quantum networking contract to design a first-of-its-kind, networked system for blind quantum computing.

The company also announced a multi-million-dollar extension of its contract with Amazon Web Services. It also announced a $9 million deal with the University of Maryland to provide state-of-the-art quantum computing access.

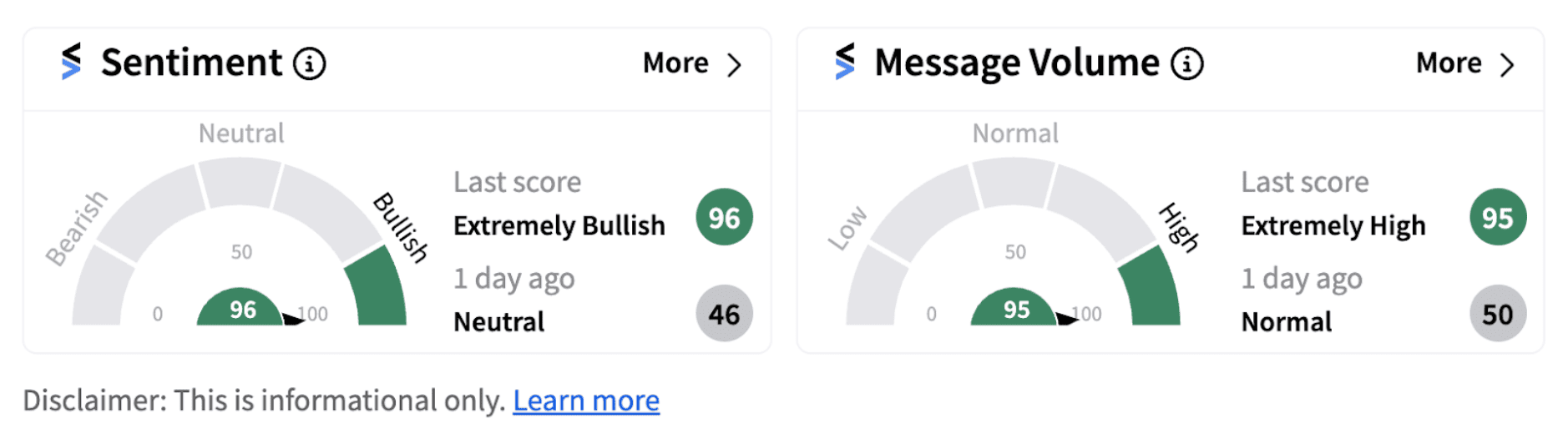

Following Friday’s announcement, IonQ became the fourth most trending ticker on Stocktwits on Friday. Retail sentiment jumped into the ‘extremely bullish’ territory (96/100) from the ‘neutral’ zone a day ago, hitting a one-year high. The move was accompanied by a significant jump in message volumes.

Despite the massive jump in IonQ’s stock price on Friday, it is still down over 18% on a year-to-date basis. Stocktwits users noted the significant rise in trading volumes and believe institutional investors might have entered or added to their positions.

One user with a bullish outlook expressed confidence in the management and believes the stock is attractive near the $10 mark.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2228106047_jpg_9b9a5ca202.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://images.cnbctv18.com/uploads/2025/02/anand-singha-thumnails-90-2025-02-69074ef2fa5040cebb8fe5d51a8f98e4.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/cnbctv18logo.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2232877160_jpg_16a992c009.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_tylenol_OG_jpg_771dcc056c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://images.cnbctv18.com/uploads/2024/05/jk-tyre-2024-05-c7ecbc39af1dfd9ed2a4fe5cd3b92cec.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Stock_chart_jpg_6c4cc95d17.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)