Advertisement|Remove ads.

Mobileye Stock Slumps As Intel Considers Stake Sale, Retail Sentiment Turns Bearish

Shares of Mobileye Global Inc. (MBLY) fell nearly 4% in pre-market trading on Friday, following a more than 7% drop that wiped out nearly $810 million in market value during the previous session.

The decline comes in the wake of reports that Intel Corp. (INTC) is exploring options to divest some or all of its 88% stake in the struggling automated driving systems provider.

Intel is said to be weighing various avenues, including selling its stake on the public market or to a third party, according to sources familiar with the matter, cited by Bloomberg.

A final decision could reportedly come after a Mobileye board meeting later this month in New York, where Intel’s plans are expected to be discussed.

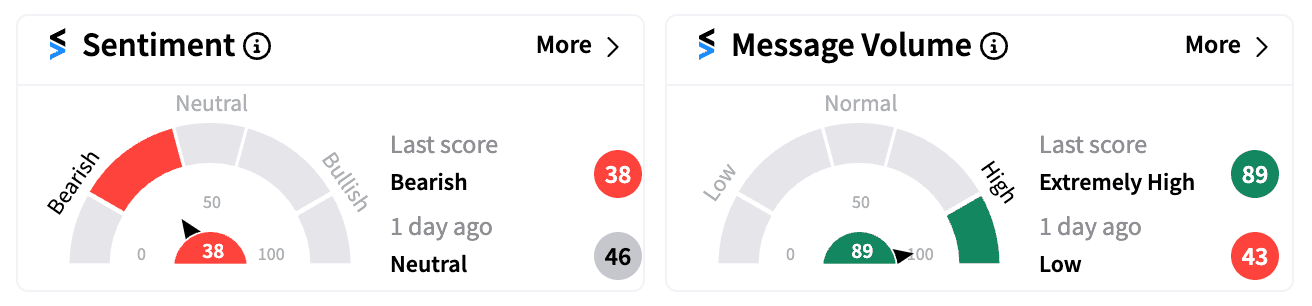

The news has sparked a sharp reaction by retail investors. On Stocktwits, sentiment around MBLY turned ‘bearish’ (38/100) from ‘neutral’, while message volume surged over 1,600%.

Retail investors expressed skepticism about Mobileye’s future prospects. One user described Mobileye as “a 20th-century solution for the 21st century,” highlighting competition from more advanced players like Tesla.

Another pointed to Volkswagen’s plans to shutter factories as a blow to Mobileye’s largest partnership, adding to fears that market share could erode further with each negative development.

Mobileye, which supplies software and hardware for autonomous driving, has been hit hard by an industry-wide slowdown, exacerbated by a post-pandemic supply glut.

The company recently slashed its revenue forecasts and significantly lowered its adjusted operating income outlook, projecting a third consecutive annual loss.

Analyst sentiment is also turning negative. Wolfe Research on Wednesday downgraded Mobileye from ‘Outperform’ to ‘Peer Perform’, citing a sharp 40% expected drop in the company’s run-rate shipments of its core Base EyeQ SoC product in China, its largest market.

The firm noted that while Mobileye is still seeing strong adoption of hands-free driving systems within China, uptake outside the country remains slow and uncertain.

As a result, Mobileye’s stock has plunged nearly 70% this year, weighed down by waning demand and increasing competition.

Meanwhile, Intel’s shares edged up 0.3% pre-market on Friday. The chip giant faces its own challenges, having posted a net loss of $1.61 billion last quarter amid fierce competition from Nvidia and AMD.

Intel is reportedly exploring strategic shifts, including splitting its product-design and manufacturing businesses, as it seeks to stabilize its financial outlook.

Read next: Broadcom Stock Drops As Revenue Outlook Disappoints, But Retail Considers Buying the Dip

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228901342_jpg_7365e02c40.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2218742693_jpg_8d1b39840a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2195880631_jpg_5d50833996.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227553102_jpg_9cb79c1b5b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2236688965_jpg_b00d009983.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2231423801_jpg_f64bcdbb33.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)