Advertisement|Remove ads.

Micron Gets A Downgrade And Price-Target Cuts, But Retail Investors Stay Bullish

Shares of Micron Technology Inc. (MU) fell over 3% in pre-market trading on Thursday after Exane BNP Paribas double downgraded the stock to ‘Underperform’ from ‘Outperform’, slashing its price target to $67 from $140.

The downgrade reflects concerns over high bandwidth memory (HBM) oversupply and the potential impact on conventional DRAM prices, with Exane predicting that Micron will underperform its artificial intelligence (AI) peers through 2025.

Micron, the largest U.S. maker of computer memory chips, plays a crucial role in AI hardware, providing high-bandwidth memory that works with processors from companies like Nvidia.

However, Exane’s earnings estimates for Micron in 2025 and 2026 are 34% and 45% below consensus, respectively, signaling a challenging outlook.

Raymond James also lowered its price target on Micron to $125 from $160, citing slower growth in non-HBM DRAM and NAND markets.

Still, the firm maintained an ‘Outperform’ rating, highlighting strong secular growth from HBM and projecting peak earnings per share (EPS) of $11-$12.

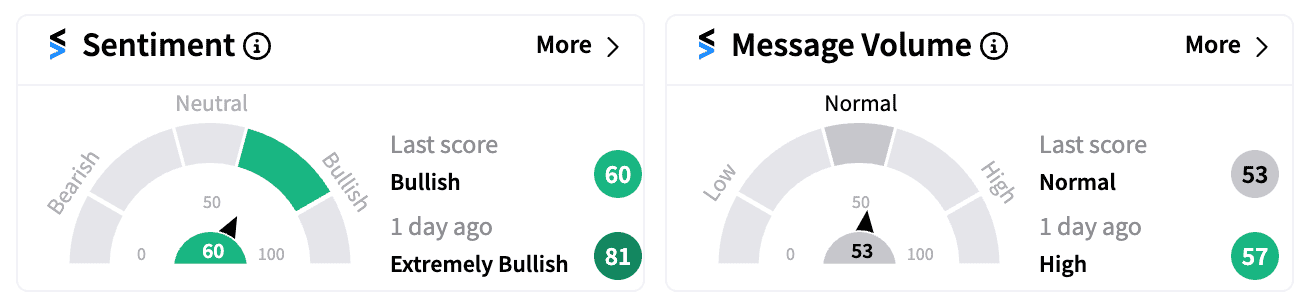

Despite the analyst downgrades, retail investors remain optimistic. On Stocktwits, sentiment for Micron was ‘bullish’ (60/100) before the opening bell on Thursday.

Many retail investors are looking past the short-term challenges, focusing on Micron’s broader opportunities, including reports of talks with Apple and Tata Group to supply components for India-produced iPhones, a potential $12 billion market.

“$MU Micron is the first American company manufacturing in India now. This will attract many big players,” noted one user.

Another added, “$MU Accumulate while cheap! Will retest earlier highs eventually! Patience Pays.”

Micron has also caught the eye of big investors; billionaire George Soros’s investment fund recently disclosed new positions in the company.

Micron’s latest earnings showed double-digit sales growth and improved profit margins, and the company is resuming its stock buyback program after suspending it nearly two years ago during an industry downturn.

Micron shares are up 10% this year, and the company is set to report fiscal fourth-quarter earnings later this month.

Read next: AST SpaceMobile Stock Top Trending Among Retail After First Commercial Satellites Launch

/filters:format(webp)https://news.stocktwits-cdn.com/large_lucid_stock_jpg_167f2bc3dd.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_So_Fi_new_6d7889a863.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_ibm_signage_resized_1a6adb0393.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2203832195_jpg_d80f13d1c7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_patrick_soon_shiong_jpg_5f4d6bc18d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2261740483_jpg_28cc9c7ce9.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)