Advertisement|Remove ads.

Nvidia Stock Slips Further On Report Of DOJ Subpoena Amid Antitrust Probe: Retail Turns Bearish

Shares of Nvidia Corp. (NVDA) declined over 3% Wednesday, following a 9% slide in the previous session. The sell-off was exacerbated by a Bloomberg report revealing that the U.S. Department of Justice (DOJ) has issued subpoenas to Nvidia and other companies as part of an antitrust investigation.

According to the report, the DOJ is ramping up its investigation into Nvidia by sending legally binding subpoenas, a step up from the initial questionnaires issued earlier.

The antitrust probe centers on whether Nvidia has engaged in practices that make it difficult for customers to switch to other suppliers, potentially penalizing those who do not exclusively use Nvidia’s AI chips.

Nvidia defended its practices, stating that the company “wins on merit” and provides value-driven solutions, allowing customers to choose what works best for them.

The news added to the broader investor uncertainty surrounding Nvidia, which lost a staggering $279 billion in market value on Tuesday alone, even before the DOJ report surfaced.

Wall Street analysts have started questioning the sustainability of the AI boom, with JPMorgan Asset Management reportedly warning that AI-related spending may not be justified without broader demand from companies outside the tech sector.

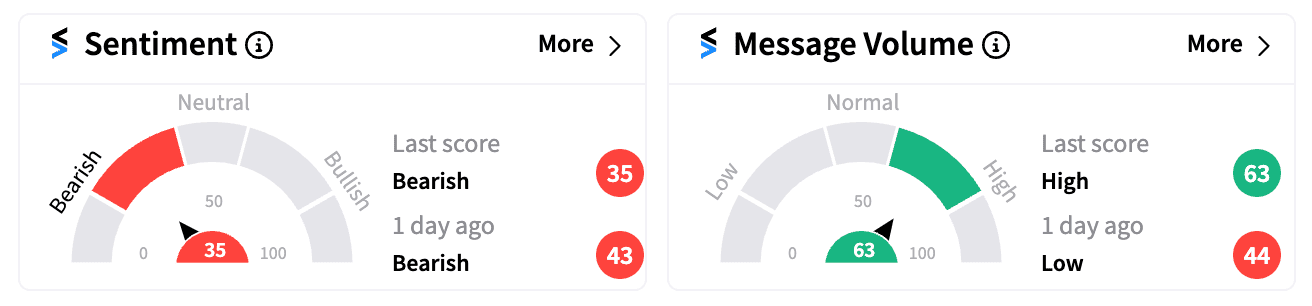

Following these developments, retail sentiment among Nvidia’s 534,000 followers on Stocktwits turned more ‘bearish’ (35/100) than from a day ago. Message volume surged over 1,120% on Tuesday, indicating growing interest in Nvidia’s evolving story.

“$NVDA recession and bubble valuation, good combo for a crash,” wrote one ‘bearish’ user, referring to the recent market slide triggered by fears of an economic slowdown.

Some retail investors appear unfazed by the DOJ’s actions, seeing the recent dip as a buying opportunity.

Melius Research analyst Ben Reitzes believes the DOJ subpoena will have minimal impact on Nvidia’s price action in the near term. Instead, he points to Nvidia’s margin performance and growth potential through 2026 as the key factors for investors to watch.

Despite the recent drop, Nvidia remains one of the top-performing mega-cap stocks of the year, boasting gains of over 124%.

Read Next: Dick’s Sporting Goods Raises Full-Year Outlook After Upbeat Earnings: So Why’s Retail Bearish?

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2229918735_jpg_e905cbd5e3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1445160636_jpg_9759816169.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250240977_jpg_5b777d96ef.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2206295220_jpg_1057588802.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2247614893_jpg_e1dcf2d2f6.webp)