Advertisement|Remove ads.

Tough Trade Restriction Report And Trump’s Comments On Taiwan Put Pressure On Chip Stocks: Here’s How Retail Investors Reacted

Shares of semiconductor firms were trending on Stocktwits on Wednesday morning after a Bloomberg report indicated that the Biden administration is considering imposing tough restrictions on semiconductor companies if firms like ASML Holding NV and Tokyo Electron continue providing access to its critical technology to China. The negative news dampened retail sentiment towards the sector.

According to the report, the U.S. is considering whether to impose the foreign direct product rule (FDPR), which would allow it to enforce controls on foreign-made products that use even the tiniest bit of American technology.

Former president Donald Trump’s comments on Taiwan also added pressure on these stocks. In an interview with Bloomberg Businessweek, Trump said Taiwan should pay the U.S. for defense and that the country doesn’t give anything.

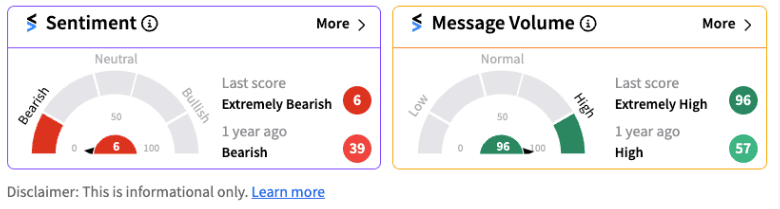

Stocktwits sentiment for ASML Holding NV flipped into extremely bearish territory (6/100) Wednesday morning, supported by extremely high message volumes. Nvidia shares fell close to 6%, while AMD shares dipped nearly 8%. Stocktwits sentiment was last seen in bearish territory for Nvidia and neutral for AMD, representing a significant change from their consistently bullish readings in recent weeks.

Screenshot for ASML sentiment meter

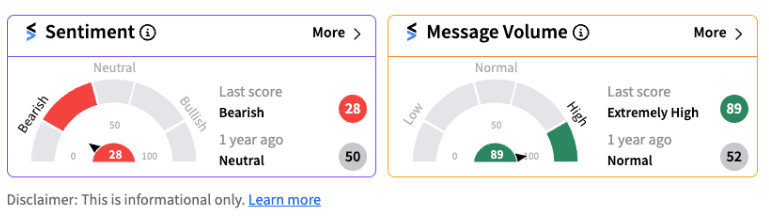

Meanwhile, Arm Holdings PLC also fell nearly 8%, and VanEck Semiconductor ETF was down about 5% in early trading. Taiwan Semiconductor Mfg Co shares also suffered a 7% decline and experienced bearish sentiment among Stocktwits users.

Screenshot for TSM sentiment meter

It’s also worth noting that the decline in ASML shares came on a day when the firm reported its second-quarter earnings that topped analyst estimates. The company announced net sales of €6.24 billion vs. the Street estimate of €6.03 billion. Net profit came in at €1.58 billion vs. an estimate of €1.43 billion. On a YoY basis, net sales rose 18%, while net income saw growth of 29%.

The firm's gross margins improved marginally to 51.50% compared to 51% in the same period last year.

ASML President and Chief Executive Officer Christophe Fouquet said the company expects third-quarter total net sales between €6.70 billion and €7.30 billion with a gross margin between 50% and 51%. “Our outlook for the full year 2024 remains unchanged. We see 2024 as a transition year with continued investments in both capacity ramp and technology. We currently see strong developments in AI, driving most of the industry recovery and growth ahead of other market segments,” he said.

Still, broader concerns about geopolitical risk outweighed the positive earnings results. We’ll have to wait and see if this bearish sentiment sticks among retail investors and traders, or if they use this pullback as a buying opportunity once again.

/filters:format(webp)https://news.stocktwits-cdn.com/large_LUNR_Intuitive_Machines_resized_jpg_5655032711.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stock_chart_falling_resized_jpg_c0ce61eff2.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_MSTR_caaa0be909.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1903197985_jpg_2c45018acb.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2203138957_jpg_dd735f9905.webp)