Advertisement|Remove ads.

TJX Turns Retail Followers ‘Extremely Bullish’ With Upbeat Earnings, Forecast Of ‘Strong Start’ To Q3

TJX Companies (TJX) — the parent company of off-price retailers like Marshalls, T.J. Maxx, and HomeGoods — is experiencing a popularity surge in both the broader market and among retail investors on the back of solid Q2 results.

Shares of TJX hit a record high on Wednesday, jumping over 5% after the company’s earnings beat analyst estimates.

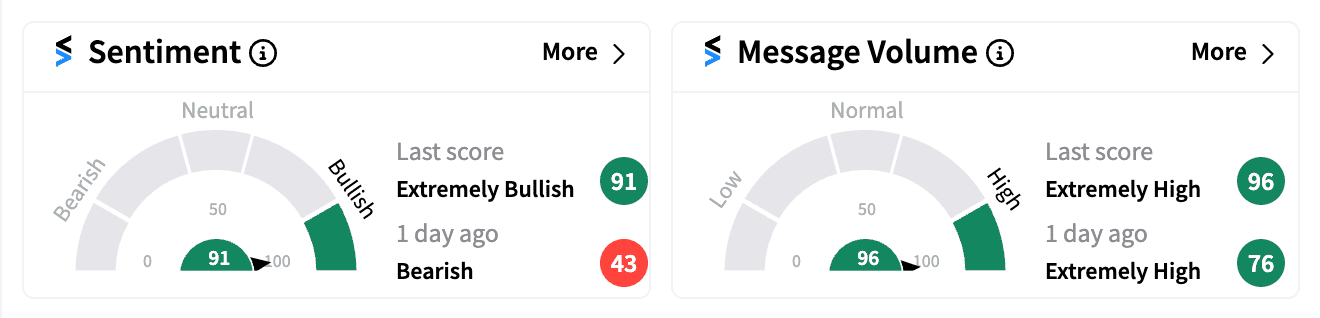

Retail investor sentiment mirrored the optimism, with the Stocktwits sentiment meter for TJX skyrocketing to ‘extremely bullish’ (91/100) from ‘bearish’ just a day prior, reflecting a significant shift in investor confidence.

TJX reported Q2 GAAP EPS of $0.96, exceeding analyst expectations of $0.91, attributed in part to easing freight costs. Sales also came in strong at $13.47 billion, beating the estimate of $13.31 billion.

Adding to the cheer, the company raised its annual EPS guidance to a range of $4.09 to $4.13, exceeding the previous forecast of $4.03 to $4.09.

According to CEO Ernie Herrman, the company's largest division, Marmaxx, fueled the success with a compelling 5% increase in comparable sales. TJX's focus on keeping prices low has resonated with cost-conscious consumers grappling with inflation.

“The third quarter is off to a strong start. We see excellent buying opportunities in the marketplace and are strongly positioned to ship fresh and compelling merchandise to our stores and online,” Herrman said.

TJX's results come on the heels of an upbeat earnings report from Target. Both companies have shown resilience in the face of inflation, potentially indicating a stronger-than-expected consumer discretionary spending environment where budget-friendly options are favored.

TJX said it expects to be well-positioned for the crucial holiday season, historically a peak shopping period for retailers.

With the stock price up nearly 29% year-to-date and outperforming the broader market, TJX appears to be a bright spot in the retail sector.

/filters:format(webp)https://images.cnbctv18.com/uploads/2024/11/2024-11-14t095510z-782457308-rc2w4baedem0-rtrmadp-3-reliance-power-renewable-enrgy-legal-2024-11-478736f8083567c30d6077a864034750-scaled.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/cnbctv18logo.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bulls_versus_bears_stock_market_jpg_c083ddc168.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_161161978_jpg_1bfd59def9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Astra_Zeneca_jpg_a49cc22562.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://images.cnbctv18.com/uploads/2020/11/enforcementdirectorate1.jpg)

/filters:format(webp)https://images.cnbctv18.com/uploads/2025/07/28-exp-15-interior-2025-07-557b59240aa96521ceb4d2ec7b6d534c.jpg)