Advertisement|Remove ads.

Roth Capital Bets On USAR’s Rare Earth Magnet Supply Chain With $40 Price Target

USA Rare Earth (USAR) received a sharp price target raise from Roth Capital, which boosted its target on the stock to $40 from $20 while reaffirming a ‘Buy’ rating.

This development follows a series of investor briefings in which Roth analysts assessed the progress toward building an independent, end‑to‑end supply chain for rare earth magnets outside China, according to TheFly. Roth’s team came away optimistic about the timeline and customer traction, noting that early magnet revenue could begin in 2026.

Meanwhile, in a boost to USA Rare Earth’s prospects, President Donald Trump on Friday warned of a “massive increase in tariffs” on Chinese products after the country announced restrictions on its global supply of rare earth materials.

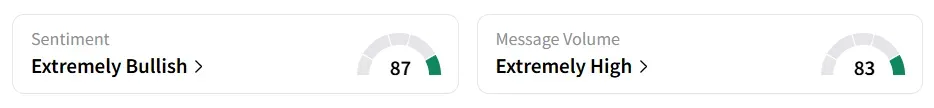

USA Rare Earth stock traded over 14% higher on Friday afternoon. On Stocktwits, retail sentiment around the stock remained in ‘extremely bullish’ territory amid ‘extremely high’ message volume levels.

A Stocktwits user said USA Rare Earth is possibly in the “top 10 most important companies in U.S. for national security and economy”.

Roth Capital highlighted that the company’s push to localize the magnet manufacturing process, from mining to magnet production, has gained momentum. Management’s engagement with prospective customers has improved visibility into order flow, strengthening the case for scaling operations, it noted.

USA Rare Earth is building a neodymium‑iron‑boron (NdFeB) magnet plant in Stillwater, Oklahoma. The rare earth magnets are essential across many sectors, including defense, automotive, aerospace, industrial, AI/robotics, medical devices, and consumer electronics.

In September, the company appointed Barbara Humpton as its chief executive officer, highlighting her experience in engaging with government entities.

USA Rare Earth stock has gained over 234% in the last 12 months.

Also See: TeraWulf’s Power Portfolio, HPC Optimism Drives Roth Capital’s Ambitious Price Hike

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2218096416_jpg_9d469a2ec6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2229019640_jpg_c6006d7238.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1190665957_jpg_92088206ed.webp)