Agricultural commodities like orange juice, lumber, sugar, soybean meal, and more have quietly been some of the best-performing assets year-to-date. 🤩

We recently discussed the rebound in lumber and orange juice squeezing to fresh all-time highs. Today we’re going to look at why wheat is getting major attention from traders.

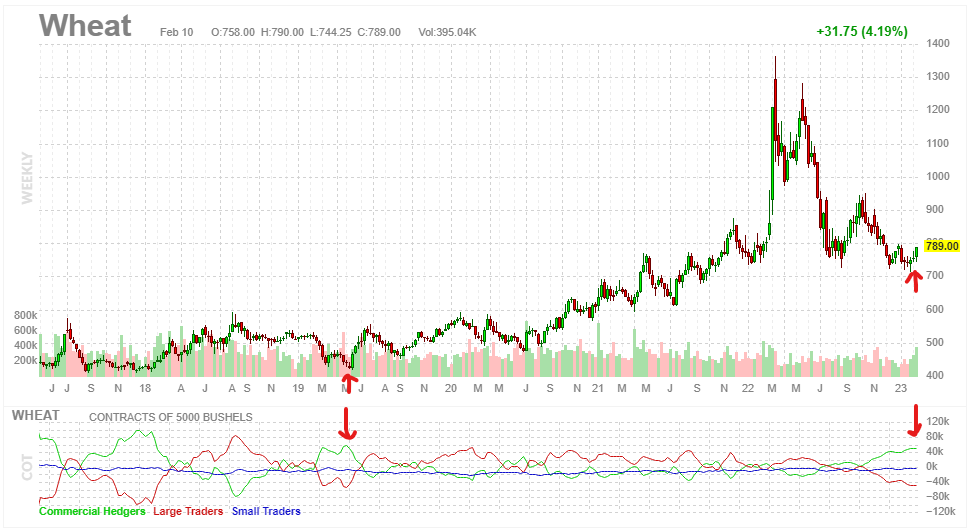

Below we’re looking at a weekly price chart from Finviz with a lower panel showing the market’s “commitment of traders” (COT) data.

For those unfamiliar, these COT reports are released by the Commodity Futures Trading Commission (CFTC) weekly. These reports are designed to increase market transparency and outline the positioning of three types of market participants: 🔍

- Commercial hedgers (companies in the business of producing/consuming wheat)

- Large speculators (large funds or institutions trading these futures in an attempt to profit)

- Small speculators (smaller institutions or individuals trading these futures in an attempt to profit)

While this data is very noisy, it can be an interesting sentiment indicator when extreme readings occur. And currently, commercial hedgers, who are the closest to the actual wheat farming / consumption business, have their most prominent net long position in the futures since May 2019. In other words, the people that should hypothetically know the market best are betting on prices going up from current levels. 🎰

That’s at least why traders are talking about it currently. Because the last time commercial hedgers had this large of a net long position (marked with red arrows on the chart), prices rallied significantly from there. And some traders are suggesting today’s move to the upside could be the start of a more meaningful price increase over the coming weeks and months.

We’ll have to “wheat and see” if these analysts are right, but it’s an interesting development nonetheless. 🤷

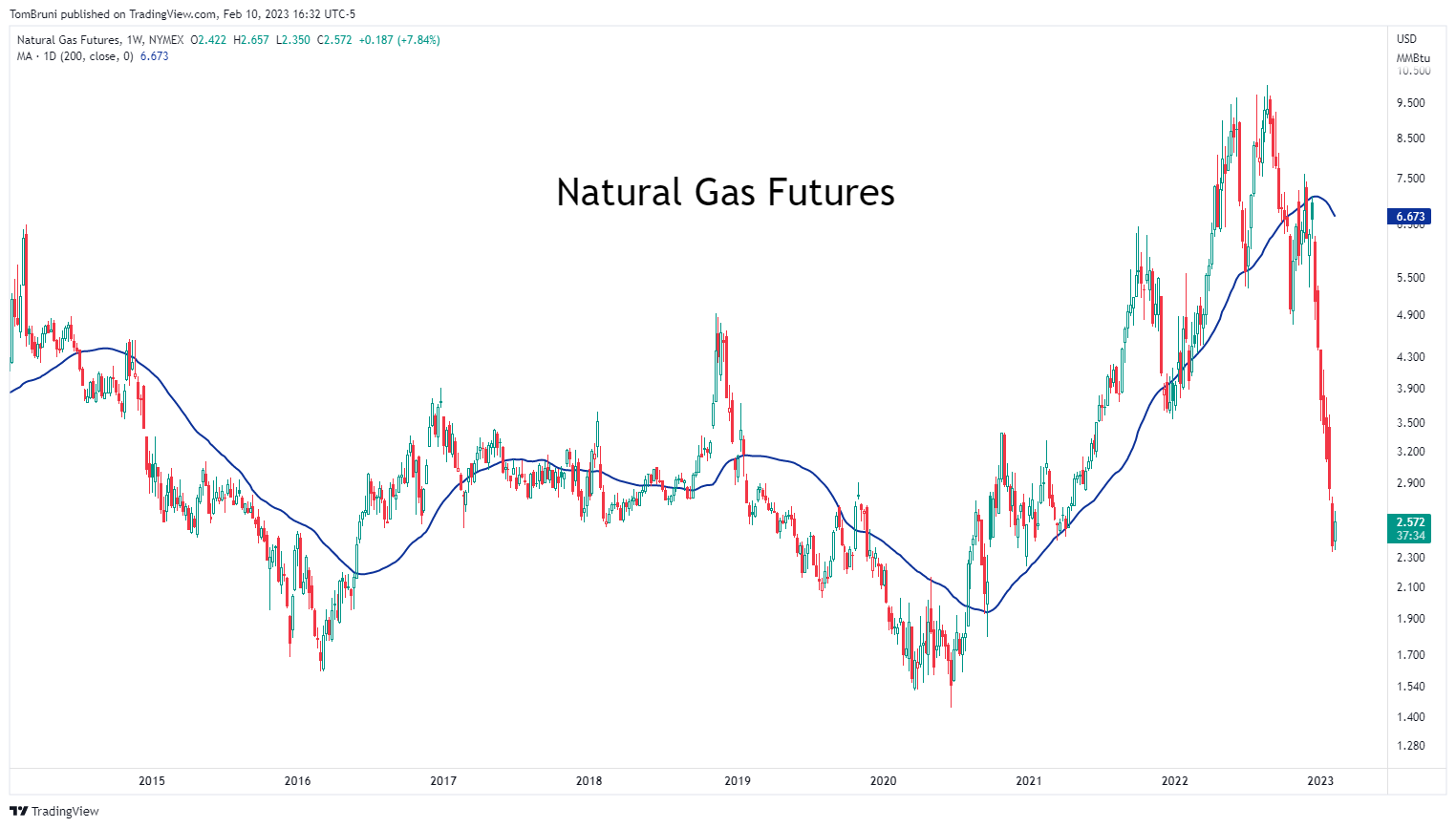

And while we’re on the subject of commodities, natural gas is another one catching people’s eyes. These futures have fallen seven straight weeks but finally stabilized this week to close +8%. 👀

The blue line is what analysts are watching here, representing the 200-day moving average. These analysts say commodities tend to be mean reverting, and this recent waterfall decline has taken prices far away from their “long-term mean” or 200-day moving average.

Some analysts point to the historical tendency of prices to revisit that 200-day moving average when they stretch too far from it. Almost like a rubber band, when it’s pulled too far in one direction, they expect it to “snap back.” 💥

Again, this type of simple analysis has a lot of flaws and should not be relied upon independently of other factors. However, after seven straight weeks of selling, this week’s price action has many traders looking for a rebound in the weeks ahead.

That’s it from this week’s check-in with our community’s commodity buffs. 📝