Retailers faced a tough decision during the pandemic:

- Grow market share by satisfying demand and risk potentially overordering; or

- Underorder and lose a lot of potential customers because of empty shelves

Most opted for the former and are now dealing with the repercussions…at least according to Target. 🎯

Just weeks after the company missed earnings amid a steep decline in operating margins, it’s now lowering its outlook even further after outlining an aggressive plan to clear unwanted inventory. 🔻

The company acknowledged it would take a short-term profit hit but noted it is acting quickly to get out in front of the issue, optimize inventory in the second quarter, and set its stores up for success in the second half of the year.

Given the commentary we’ve heard from a range of retailers like Walmart and Gap, this may be the start, not the end of further guidance adjustments in the industry. 🏬

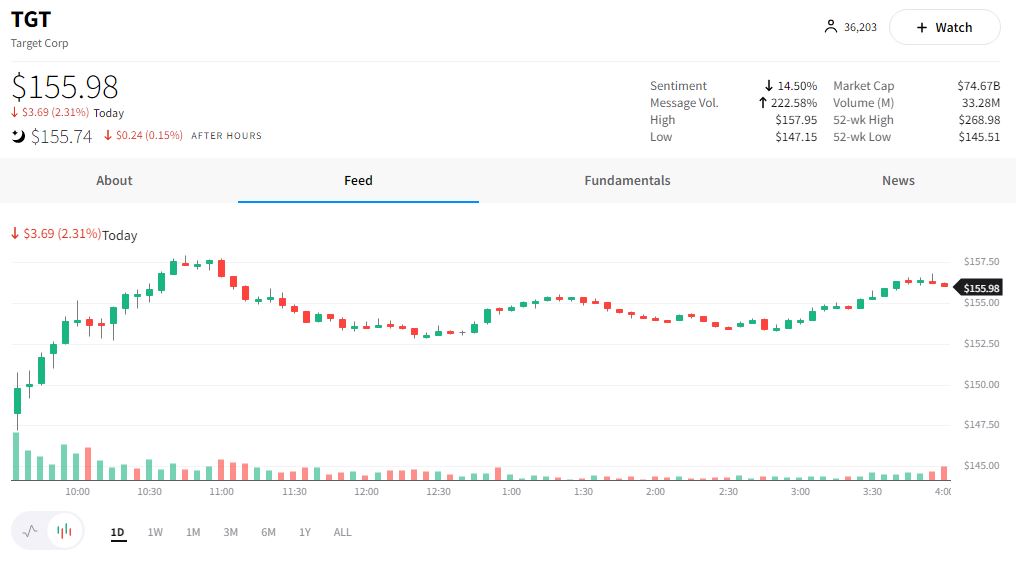

The stock gapped down about 10% at the open but rallied back throughout the day to close -2.31%. 📈

Given the ability of Target and the overall sector to rally back after bad news, could it be possible that enough bad news is baked into the stocks already? 🤔

I guess we’ll have to wait and see. 👀