After investors *rolled back* the prices of Walmart shares yesterday, trouble in the Retail industry continued with Target missing forecasts in a big way.

The company’s adjusted earnings per share missed the $3.07 expected by analysts, coming in at $2.19. Revenues did beat expectations at $25.17 billion vs. $24.49 billion.

The numbers came as a surprise to investors given the company’s upbeat 2022 guidance in March, where it forecasted adjusted profit in the high single-digits and suggested supply chain constraints were steadily working out. 🤯

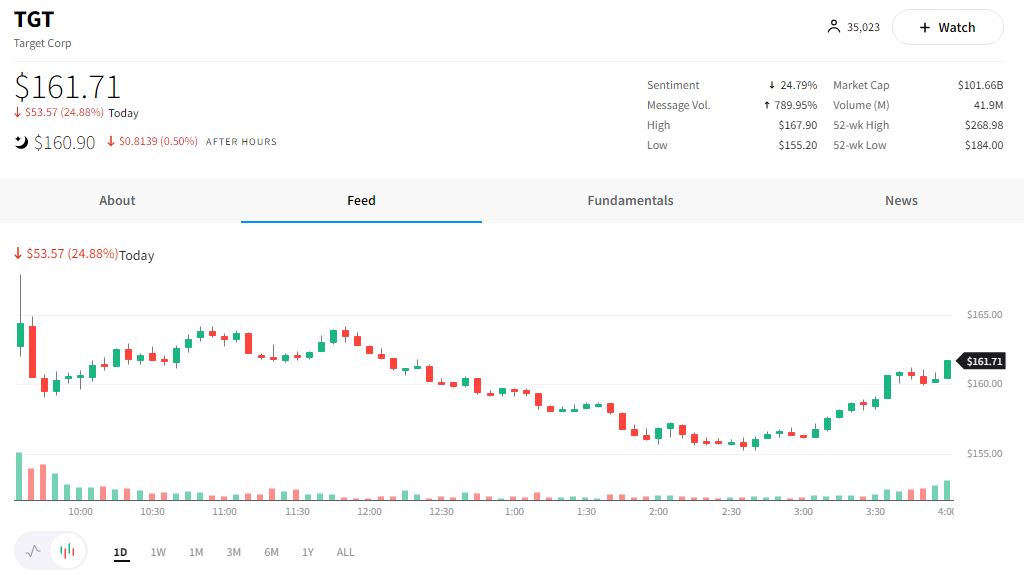

Investors quickly sent $TGT shares to the clearance shelves, knocking it down ~25%. 👎

Operating income margin was a significant focus, falling to 5.3% compared with 9.8% in the same period last year.

The company noted various factors that drove this decline in margins, including supply chain constraints, excess inventory, and a shift in product mix to lower-margin items. As a result, the company now expects an operating income margin rate “in a range centered around 6%” for the year.

CEO Brian Cornell stated, “Things have changed significantly from even 13 weeks ago… We did not project, I did not project, the kind of significant increases we would see in freight and transportation costs.”

The company now expects about a billion dollars of incremental freight costs this year, even compared to expectations outlined three months ago. 🚚

These comments echo much of what we saw from Walmart yesterday and Amazon a few weeks back when both companies highlighted that increased costs were eating into profits.

Despite the short-term hit to profitability, the company remains focused on its long-term trajectory and gaining market share.

Target noted that passing rising costs onto its customers via broader price increases is the last lever it would pull to improve profit. The company is also not changing its planned annual capital expenditures of $4-$5 billion.

Despite significant issues on the expense side of the equation, revenue numbers did offer a few bright spots: ☀️

- Comparable sales grew 3.3% YoY, reflecting traffic growth of 3.9% YoY

- Store comparable sales increased 3.4% YoY

- Digital comparable sales grew 3.2%YoY

- Same-day services grew 8% YoY

With inflation sitting near 40-year highs, it’s clear that these issues are not going away anytime soon. In this environment, the major challenge for the retail sector is going to be balancing its long-term focus on the customer and the often short-term demands of Wall Street investors. ⚖️

For now, retail investors’ eyes shift to $BJ, $ROST, and $DECK which report tomorrow. 👀