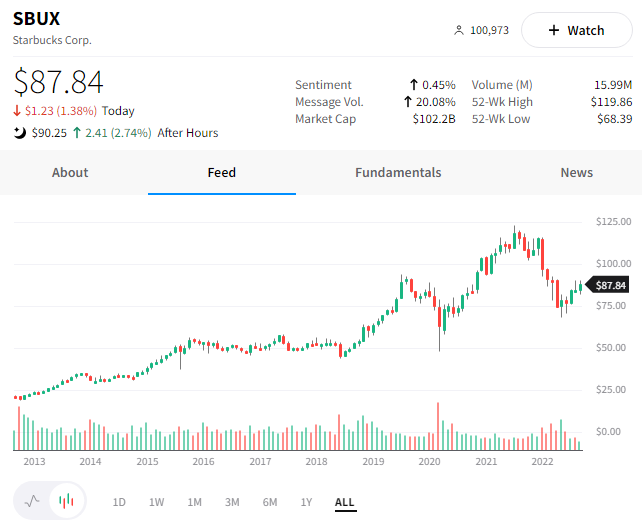

Starbucks has not been exempt from the market’s wrath over the last few years. The stock is trading at the same level as three years ago and remains 40% below its all-time high set in 2021. However, at today’s investor day, Starbucks outlined a plan that it hopes will reenergize its performance. ☕

The event, led by interim CEO Howard Schultz, presented actions and target investments in the company’s partners, customers, and stores which it expects to accelerate its long-term growth.

Additionally, Schultz introduced incoming CEO Laxman Narasimhan, who will officially join on October 1, 2022. After working with Schultz through the transition period, he’ll assume the CEO role and join the Board of Directors in April 2023.

The company’s plans included a few key categories, which we’ll summarize.

First, the company wants to improve its partner experience to develop a thriving network. For fiscal 2023 it identified several solutions designed to do just that, including:

- Wage and recognition innovation;

- New well-being benefits;

- Personalized career mobility; and

- Investments in store managers

On the customer experience side, it has several goals, including:

- Investing in purpose-built store concepts;

- Delivering beverage innovation; and

- Expanding effortless digital convenience

And finally, internationally, it will roll out efforts to improve its leadership position, including:

- Strengthening its licensing model;

- Accelerating the digital Starbucks experience; and

- Adopting a purpose-driven growth agenda in China

The company also spoke about its leadership position in the at-home and ready-to-drink market, which it says has a long runway for growth.

Whether or not investors believe in the “reinvention plan” remains to be seen. While a day doesn’t make a trend, the stock did outperform the broader market today in a very tough tape. 🤷