EVGA, one of the largest manufacturers of graphics card add-in boards, is quitting the board business for two reasons.

Its first reason is the sector’s financial outlook turned bleak after the Ethereum Merge, which moved the cryptocurrency from proof-of-work to proof-of-stake. ⚒️

Second, it stated “mistreatment” from its partner Nvidia. Despite holding 40% of the North American market share of Nvidia cards, it says Nvidia kept it in the dark on prices until the last minute and undercut it by selling its own first-party branded cards.

On top of that breakup news, America’s favorite pundit is now short Nvidia, calling it “a loser.” Cramer stated that higher-end products needed for machine learning are too far out to produce earnings. Meanwhile, the company’s lower-end products are being hurt by the Ethereum merge, the overall decline in the crypto space, and the steep drop in gaming demand.

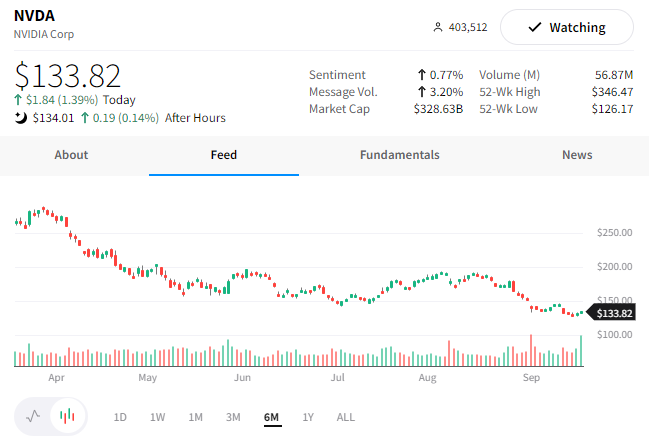

With $NVDA shares already down 65% from their all-time high, we’ll have to see if the bearish bets pay off. Or if the “inverse Cramer” indicator continues its hot streak. 😂