Apple is continuing its push into the services business, this time targeting the popular “buy now pay later” (BNPL) space. Today the consumer tech giant introduced its “Apple Pay Later” feature, allowing consumers to pay for purchases over time. 💳

Soon, Apple Pay users can split purchases into four payments at no cost. The four payments will be spread over six weeks without interest, fees, or immediate impact on their credit score. Users can apply for loans ranging from $50 to $1,000, which can be used for online and in-app purchases and at merchants that accept Apple Pay.

Apple says there’s no one-size-fits-all approach to how people manage their finances. And as more people look for flexible payment options, the company wants to help fill that need…with some guardrails. 🦺

The company will use a “soft credit pull” to judge the borrower’s creditworthiness before approving the requested loan. And since users will view and manage their loans straight within Apple Wallet, Apple says they’ll have all the information they need to make responsible borrowing decisions. They’ll also be required to link a debit card to ensure timely payments and prevent them from paying back the debt with other forms of debt. 🏦

As for consumers, the six-week “free” loan is an alternative to longer-term offerings from Affirm and other BNPL competitors that are often higher cost. Apple plans to begin reporting the loans to the three major credit bureaus in the fall. That means consumers who don’t pay what they owe will see an impact on their credit score, as they would with most other credit products. 📝

The Mastercard Installments program enables Apple Pay Later, with Goldman Sachs acting as the issuer of that program. That means merchants who already accept Apple Pay will not need to make any changes to participate in the new service offering. 📱

With consumers demanding more payment flexibility, it makes sense that Apple would offer it. Of course, they already have the Apple credit card, but this could be an attractive alternative for those that don’t qualify or would prefer not to open another account.

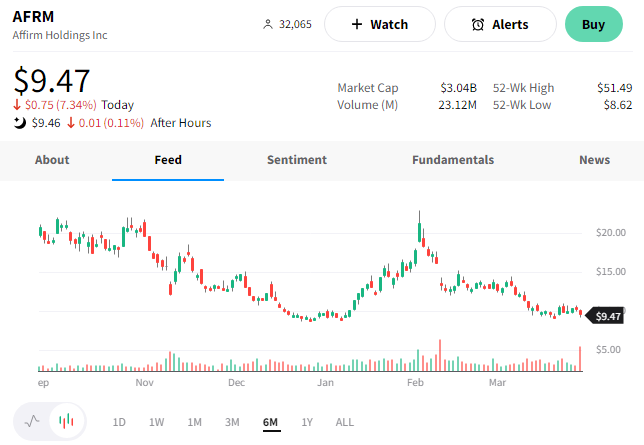

Apple shares barely budged after the announcement. However, BNPL stock Affirm saw its shares fall more than 7% as investors weighed the impact of further competition. 🔻