Yesterday, Disney said it was considering selling its ABC television network assets as it looks to focus purely on ESPN (sports) and its streaming business. Local broadcaster Nexstar was the expected buyer, but today, we may have found out who another potential bidder is. 👀

Media mogul Byron Allen has reportedly offered $10 billion to purchase the ABC TV network and cable networks FX and National Geographic. So far, it looks to include the national TV network and several regional stations, but terms could change anytime. 📺

Allen Media Group owns the Weather Channel and several regional sports networks and broadcast TV stations. Its roughly $10 billion offer assumes an 8x multiple on the network’s $1.25 billion in earnings before interest, taxes, depreciation, and amortization (EBITDA).

While a generous offer, the potential deal will likely develop as Disney courts more suitors now that the assets are officially (and publicly) in play. ⚔️

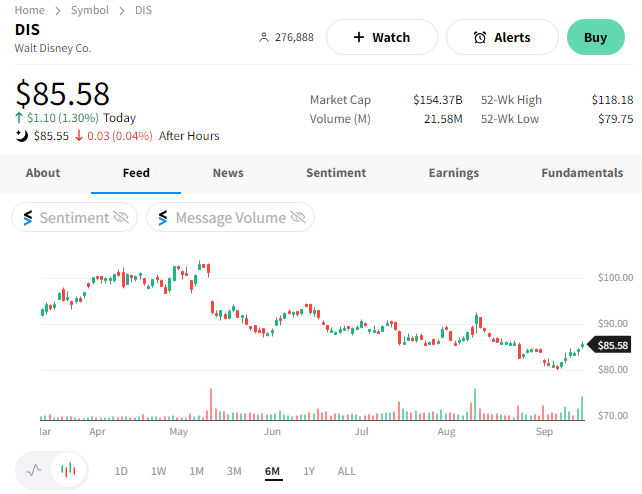

$DIS shares continued their slow recovery after reaching nine-year lows late last week. Bob Iger said he was coming back to shake things up. And shake things up he is. 🤪