Investors hoping that SmileDirectClub would receive the same “meme stock” treatment as Yellow Corporation, Bed Bath & Beyond, and other bankruptcy filers were left severely disappointed. 😢

Friday after the bell, the dental aligner company announced that it filed for bankruptcy four years after raising $1.35 billion in its initial public offering (IPO). Its Chapter 11 filing and a loan of at least $20 million from the company’s founders will allow it to operate as it tries to reorganize.

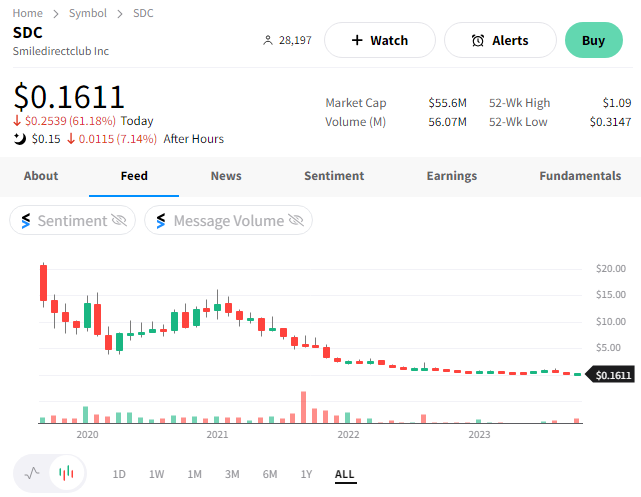

Since the announcement came after the market had closed, there wasn’t much of an initial reaction. That left some traders hoping it would experience a pop and short-term upside momentum on Monday morning. But it did not. Instead, $SDC shares fell another 61% to fresh all-time lows. 📉

Unfortunately, the public markets will not bail the company out by pumping the stock price and allowing it to issue more equity. And if it doesn’t find a buyer soon, it will be forced to liquidate. Chief Financial Officer Troy Crawford said in the bankruptcy court statement, “If no bidder is found by November 23, SmileDirectClub will shut down and liquidate.” 💰

It was on track to generate free cash flow by the fourth quarter of this year but has been unable to secure the funding needed to get it there. As a result, its more than 1,800 employees and many other stakeholders remain at risk. 😢