With Microsoft’s acquisition of Activision Blizzard officially complete, the S&P 500 needs to replace it with another stock. And this time, that stock is Lululemon. 🤩

The athleisure retailer saw shares jump more than 10% today, reacting to Friday’s after-hours news that it would be added to the index before the market opens on October 18, 2023.

So why does this matter? Well, because the S&P 500 is one of the world’s most widely tracked and indexed products, asset managers will have to buy the stock in any of their products that track (or are benchmarked against) it. Otherwise, their funds risk developing a “tracking error,” meaning they’re not correctly matching the index’s performance. 💰

It’s important to note that inclusion in the S&P 500 index often leads to a short-term pop in the stock as buyers look to ride the wave of asset managers forced to buy the stock. However, several studies have suggested that index inclusion creates “no permanent effect” on market value after joining the index.

Simply being included in the index doesn’t guarantee the stock’s long-term success. After all, it has to continue to be a strong business/security if it wants to hold its place in the index. Otherwise, it’ll be booted to the curb like many before it. 👋

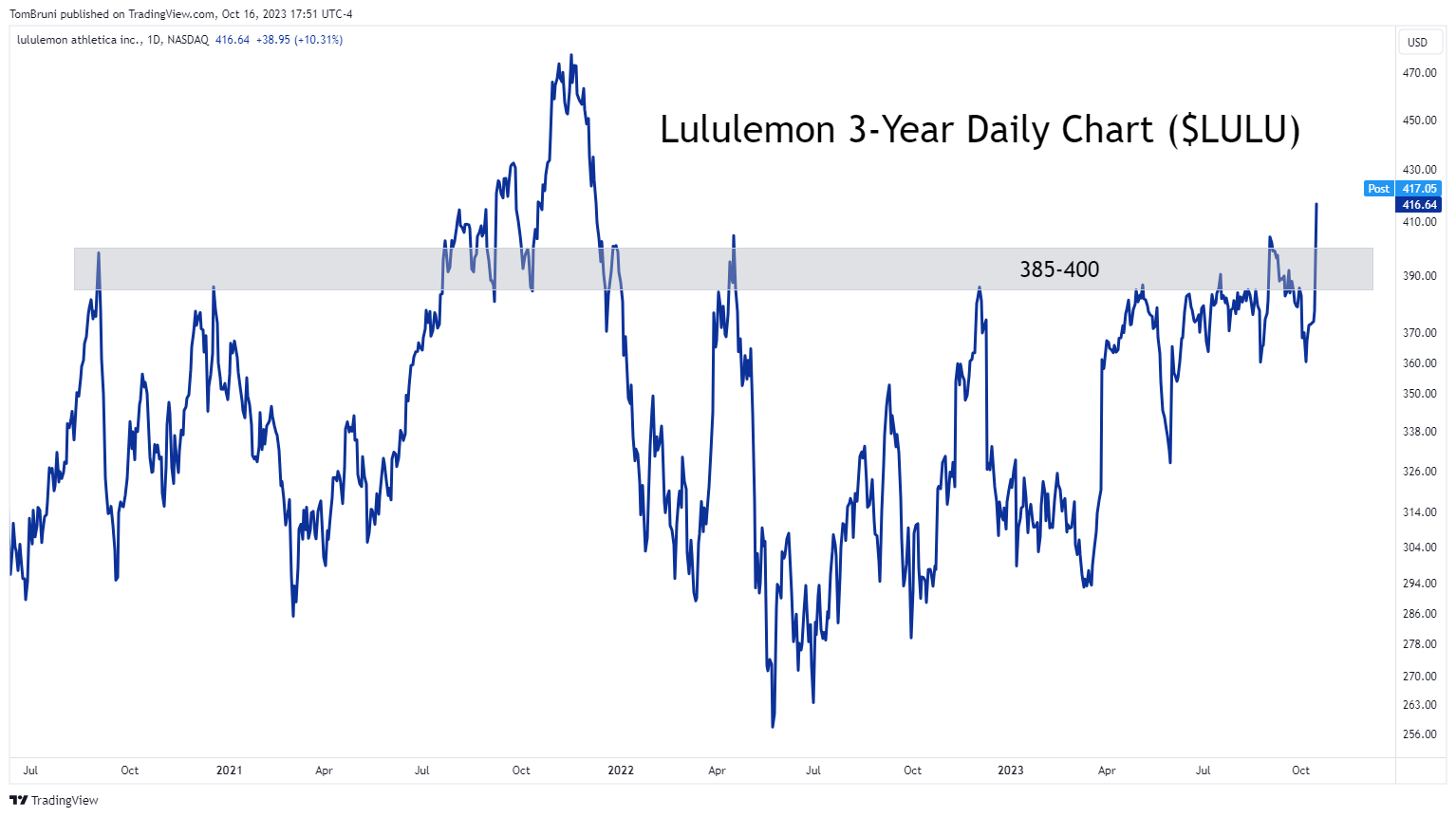

In the meantime, today’s gap-up was a big move for traders and investors using technical analysis. With prices closing at nearly two-year highs and above multi-year resistance at 385-400, technical analysts say this likely marks the resumption of the stock’s long-term uptrend. Time will tell, but $LULU shares will surely be on people’s radars until the dust settles. 👀