It was another busy day for artificial intelligence (AI) news, with three U.S. tech giants unveiling new information and C3.ai reporting earnings. 📰

Let’s quickly cover the more concise news before jumping into earnings, starting with Google launching its new AI model that it hopes will take down GPT-4. CEO Sundar Pichai said that Google is entering a new era of AI: the Gemini era.

Gemini is its latest large language model, first teased at the I/O developer conference in June. But the most exciting part is that this new technology will have impacts across all of Google’s products. Essentially, it can work on the underlying Gemini technology and have the improvements immediately flow across all its products.

Meta also launched a standalone AI-powered image generator on the web called Imagine with Meta. The new tool allows users to create images by describing them in natural language, similar to DALL-E, Midjourney, and Stable Diffusion. However, it’s facing some pushback for not including a watermarking feature to let viewers know an image was created using the technology, something it says it will add shortly.

Meanwhile, Apple has silently been working on AI in the background and is now making a splash. Its machine learning research team released a framework called MLX to build foundation models. The frameworks and model libraries it quietly released are designed to run on its chips and potentially bring generative AI apps to MacBooks.

It’s also important to note that MLX has been released through open-source repositories like GitHub and PyPl as it looks to encourage adoption as Apple makes its slow push into the space.

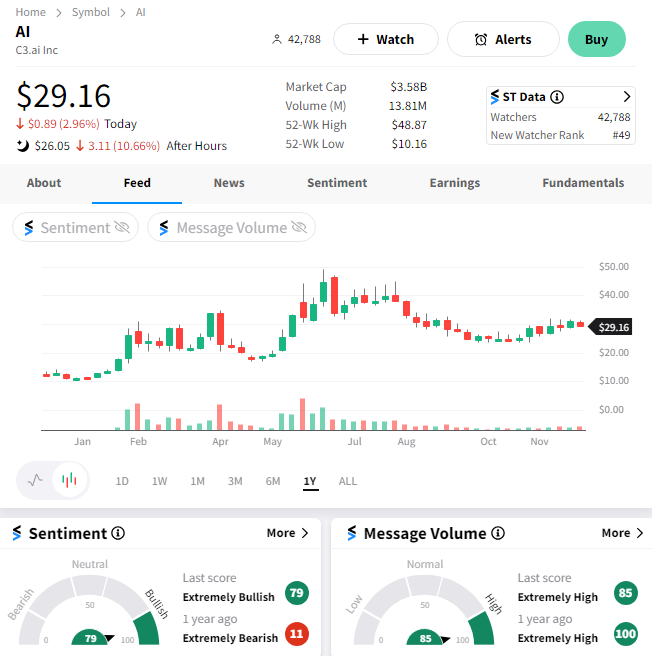

Finally, let’s take a look at C3.ai’s earnings. The enterprise AI software company saw revenues rise by 17.3% YoY to $73.23 million but missed expectations. Meanwhile, its adjusted loss per share of $0.13 beat expectations by $0.05. 📝

Subscription revenue was 91% of total revenue, growing 12% YoY and making up 91% of its total revenues. And its cash of just over $760 million, investors are not worried about it going out of business anytime soon.

However, given the hype around AI currently, investors were anticipating stronger revenue growth from a company with AI in its name. Looking ahead, its total revenue outlook for next quarter and 2024 were mixed vs. consensus estimates. It’s not the gangbuster report many were looking for to maintain the stock’s recent momentum. 📊

As a result, $AI shares are falling about 11% after the bell. The company also continues to battle back against a short seller report issued in April, claiming accounting errors at the company, among other things. Nonetheless, that has weighed on sentiment among its investor base. 😬