While today ended mostly in the green for crypto, it’s still ugly for Bitcoin ($BTC.X) and the broader crypto market. Yesterday’s daily close was the lowest for Bitcoin in just over 20 months – December 13, 2020. The slide below $19,000 is the first time since July 4, 2022.

Today’s price action is a little more upbeat but certainly not anywhere close to regaining even half of yesterday’s losses. Beyond the technical levels, though, there is a collection of important fundamental considerations.

Just like Bitcoin’s overall price action, the market dominance percentage BTC makes up of the entire crypto market cap has dropped. Currently, BTC dominance sits a hair below the 40% level at 39.23% – the lowest in 4.5 years.

However, despite the drops in price and dominance, many Bitcoin hodlers remain in profit, even after a 60% crash.

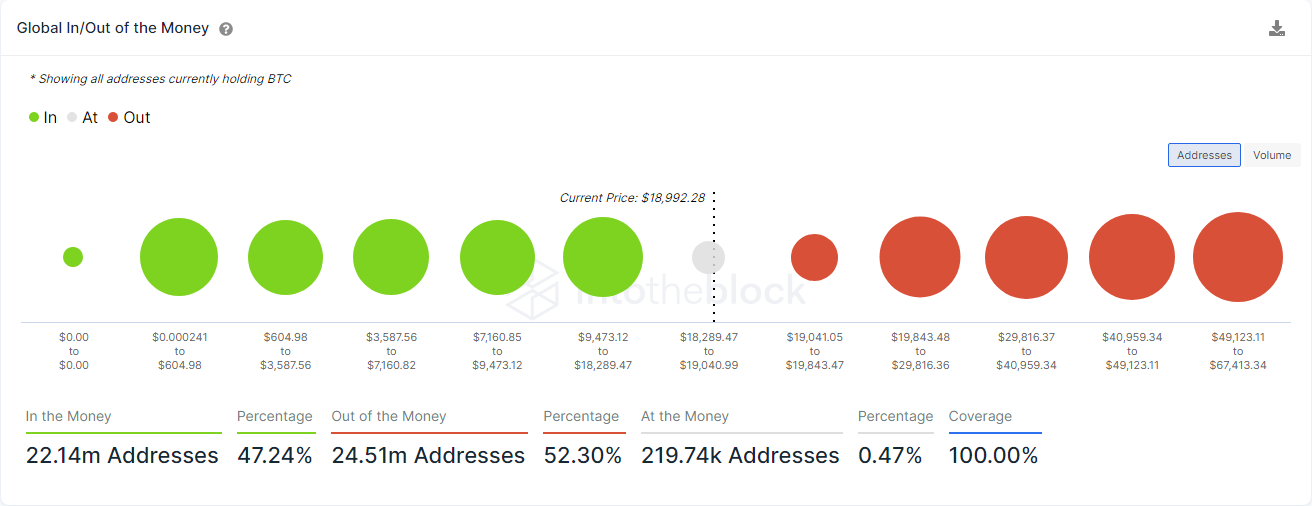

IntoTheBlock, an on-chain analytics service, reports that 47% of hodlers are in profit – that’s less than 50% and not even a simple majority, but it’s certainly more than the graphic below:

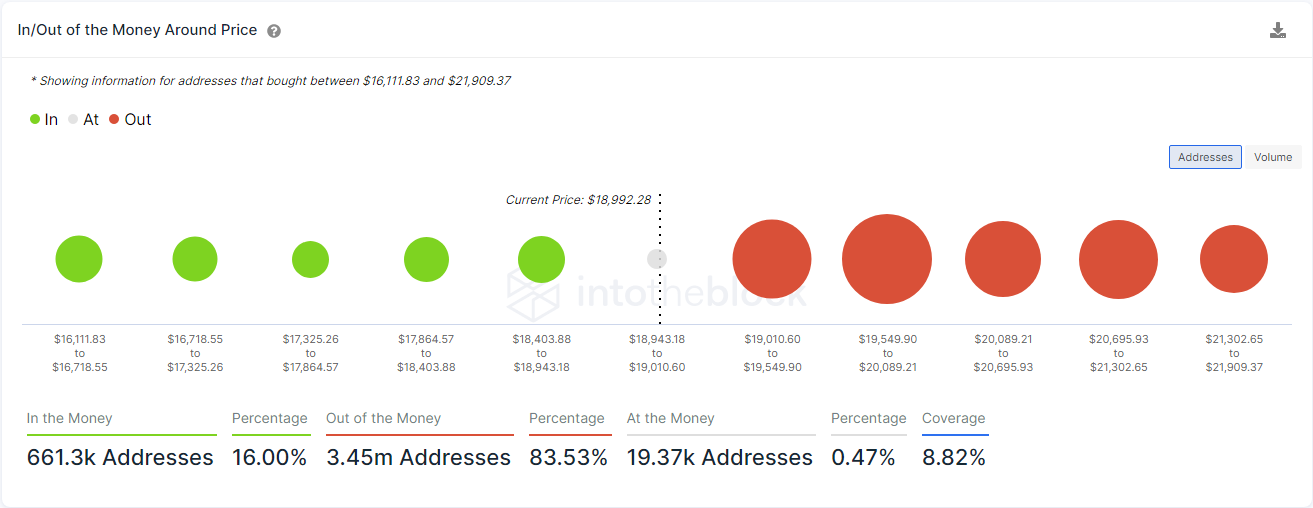

The graphic above shows the In/Out of the Money of addresses that bought BTC between $16,111.83 and $21,090.37. A staggering 83.53% of those addresses are in the red and down, while only 16% are in the green.

Despite the bearish nature and positioning, the market has not displayed a massive lower breakdown. Follow-through is necessary. 🧠