There have been many ups and downs today, with many cryptocurrency traders skittish that a top may be in, and the nice run higher is about to reverse. ↕️

Polkadot

$DOT.X, like the rest of the crypto market, has been all over the place today. It was trading up +4.19% higher before giving up all of those gains and turning them into losses.

Polkadot’s chart shares many conditions similar to many of the top 25 cryptocurrencies (by market capitalization).

- Broke out and closed above the Cloud on the daily chart.

- Had large gaps between the bodies of the candlesticks and the Tenkan-Sen.

Analysts are watching several levels on Polkadot’s chart very closely. The first is the Chikou Span – which reacts to the same support and resistance levels as the current price action.

Ever since the Chikou Span returned to the Cloud on January 14, it’s been testing the bottom of the Cloud (Senkou Span A) as support.

The second level on analysts’ radar is the top of the Ichimoku Cloud – Senkou Span B ($5.90). Senkou Span B is the strongest level of resistance/support within the Ichimoku system.

If there’s one condition neither bulls nor bears want, it’s for price to stay inside the Cloud. The Cloud represents indecision, volatility, and everything bad in the universe. It’s where trading accounts go to die.

Bulls want to see a daily at or above $5.91, which would put DOT above the Cloud. 🐂

Solana

Oof. The daily chart for $SOL.X is ugly if you’re a bull.

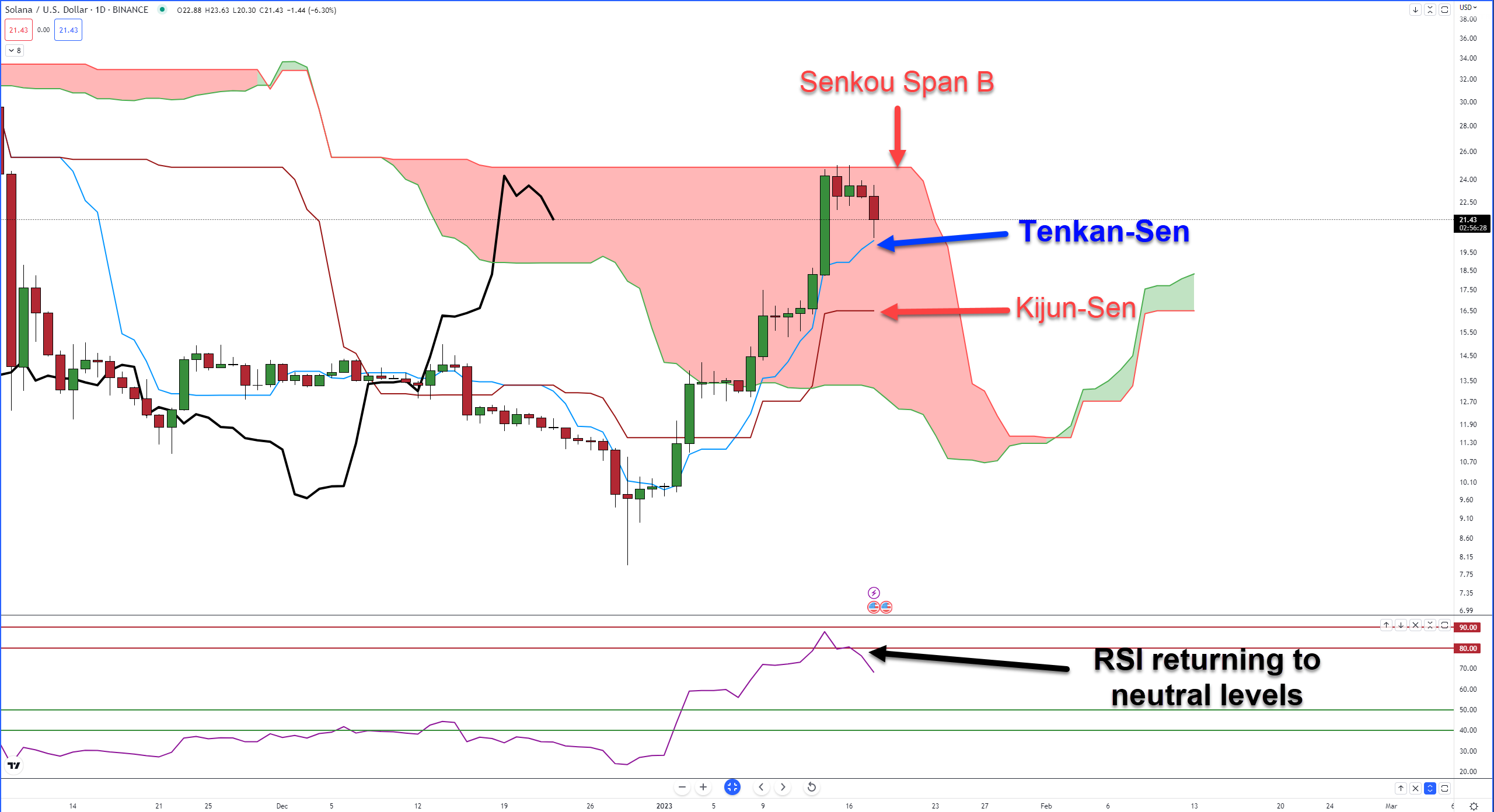

From an Ichimoku perspective, it’s no wonder that Solana has had difficulty moving higher since January 14. Just take a look at the top of the Cloud (Senkou Span B at $24.91).

Not only is Senkou Span B the strongest support/resistance level within the Ichimoku Kinko Hyo system, but that strength is exacerbated when it stays flat for a long time.

The current length of Senkou Span B’s flat condition is 33 days – the third longest in Solana’s history.

In addition to Senkou Span B, bulls had to contend with the psychologically important $25 price level and the same gap problems discussed in Polkadot’s chart above.

Now that price has returned to equilibrium by returning to the Tenkan-Sen, does that mean Solana will continue its drive higher? Some analysts don’t think so.

The RSI returned to bull market conditions (overbought 80 and 90, oversold 50 and 40) and is currently falling out of the overbought levels and back into neutral territory.

However, some conservative bullish analysts want to see Solana fall even lower to $16.62 for two reasons.

First, a return to $16.62 would test the Kijun-Sen as support.

Second, the RSI would likely fall near the 40 or 50 levels to test as support. If they hold, then conservative bulls see a strong probability of Solana making another swing higher. 🐻