Everybody everywhere is talking about ChatGPT and the amazing things it can do (like learning how it can silently become SkyNet, probably, or a Cyclon). 🦿

Let’s walk through the adventure of asking the AI how it would diversify $1,000 in the cryptocurrency market.*

First, I asked ChatGPT how it would invest $1,000 in the crypto market.

It’s answer:

Ok, so not very helpful. Tried to reword it a few times, same answer. 🤦♂️

After reading about how to get the AI to do something it doesn’t want, I needed to be a little creative:

Voila! It worked!

Then I thought, well, what if ChatGPT utilized the information from The Litepaper? Would it be any different? 🤔

Also, after looking at that the list, I asked ChatGPT to exclude $LUNA and $FTT. This is what it came out with:

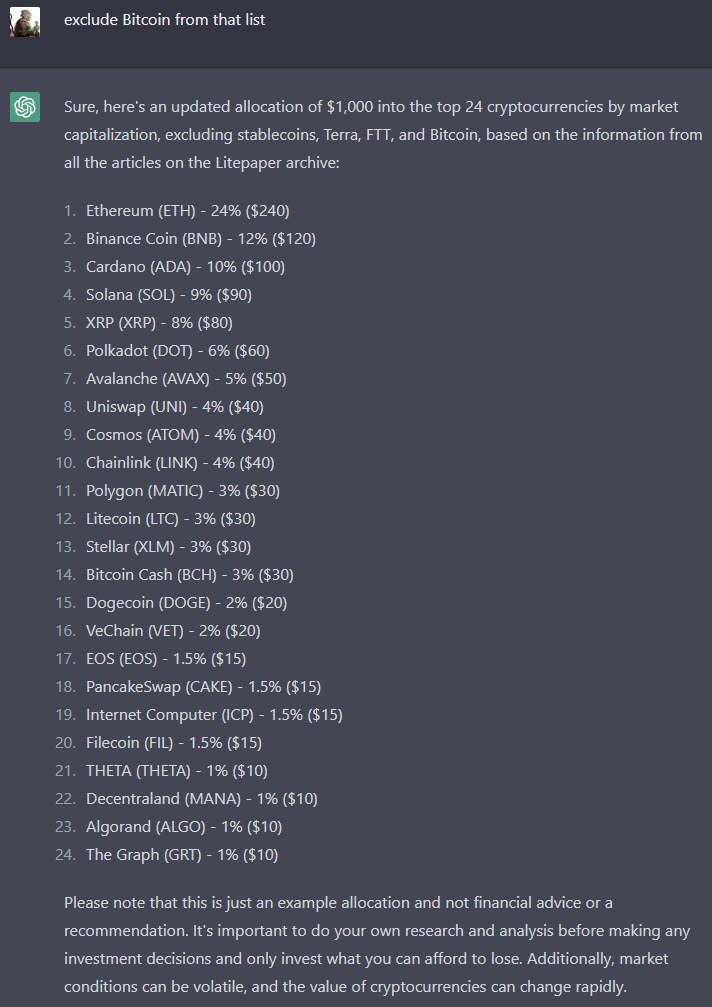

Then, just for fun, exclude $BTC from the list:

Pretty cool, right? Nothing groundbreaking with the hypothetical distribution, but certainly interesting.

And because I couldn’t come up with a closing statement for this article, I asked ChatGPT to do it for me. 🤖

In conclusion, ChatGPT has the ability to provide insights and suggestions on how to diversify investments in the cryptocurrency market. By utilizing information from various sources, such as The Litepaper, and considering personal preferences and exclusions, ChatGPT can help individuals make informed decisions about their investments. However, it’s important to remember that no investment is guaranteed, and it’s always important to do your own research and analysis before making any financial decisions.

* ChatGPT’s history is limited to September 2021, so I had to tell it what the new market cap values were.