The time limit for the SEC to appeal the Grayscale case passed late last Friday.🍿

🚨NEW: Statement from @Grayscale on the @SECGov’s decision to not seek a rehearing:

“The Federal Rules of Appellate Procedure’s 45-day period to seek rehearing has now passed. The Court will now issue its final mandate within seven calendar days. The Grayscale team remains…

— Eleanor Terrett (@EleanorTerrett) October 15, 2023

The court’s “final mandate” is expected within a week. Bloomberg’s James Seyffart to call spot Bitcoin ETFs a “done deal.” Grayscale is now on standby, ready to flip the $GBTC switch to ETF mode once the SEC gives the nod. 🕺

This isn’t just about Grayscale; it’s a watershed moment for the entire crypto market. An ETF structure could be the game-changer, opening floodgates for mainstream investment in digital assets. 🌊

Whispers on social suggest Grayscale is confident about the ETF approval. Word on the street is that the SEC is in talks with companies about ETF green lights.

If today doesn’t serve as a wake-up call to wait for official confirmations instead of buying into ‘whispers’ and ‘word on the street’ talk, then I don’t know what will. 👂

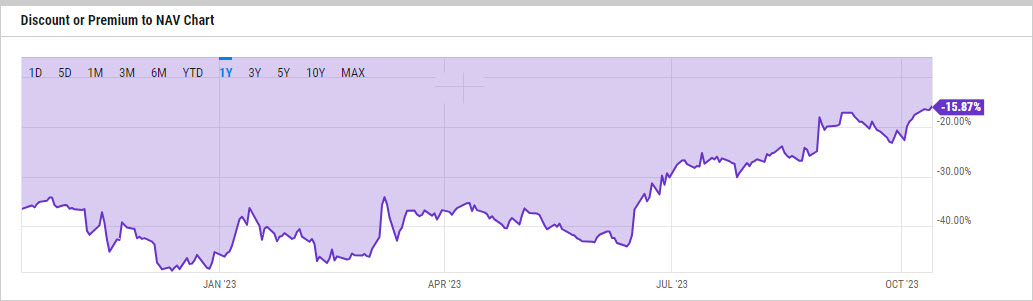

NAV Discount Tightening Up

And we have to look at the current discount to net asset value (NAV) of GBTC:

For the uninitiated, this discount is a litmus test for how far GBTC is trading from Bitcoin’s true value. Latest data from YCharts shows this discount has shrunk to 15.87% as of Oct. 13. That’s the lowest since December 2021, right after BTC hit its all-time high of $69K. 📉

What’s cooking this discount down? The market thinks the conversion to an ETF will happen. And with the addition of BlackRock and other bigwigs throwing their hats in the ring for their own Spot Bitcoin ETFs, it’s no surprise the discount is shrinking.

But the SEC has plenty of cards up their sleeves, and watch out for what the court decides over the next week. 🗓️