Yesterday, we wrote about the upcoming Securities & Exchange Commission (SEC) decision on the spot Bitcoin ETF and how the market is optimistic all the current applications will be approved by EOD Wednesday. And today, the market was tricked into thinking a decision had been made. But as it typically goes with crypto, things were more complicated than they first appeared.

It all started when the official Securities & Exchange Commission X account tweeted the below message, implying that all spot Bitcoin ETF applications had been approved. 🤩

However, fifteen minutes later, the regulator’s Chairman tweeted that the X account was compromised and posted an unauthorized tweet. In other words, the SEC had not made a decision on the investing products just yet. ⏪

This sent Bitcoin prices rising and falling sharply, with market participants searching for an explanation everywhere.

One theory from Bloomberg ETF analyst Eric Balchunas suggested the tweet was supposed to be scheduled for tomorrow but was erroneously sent today. However, that faced significant pushback from people saying the SEC wouldn’t use #Bitcoin or the emoji in an official release. 🤔

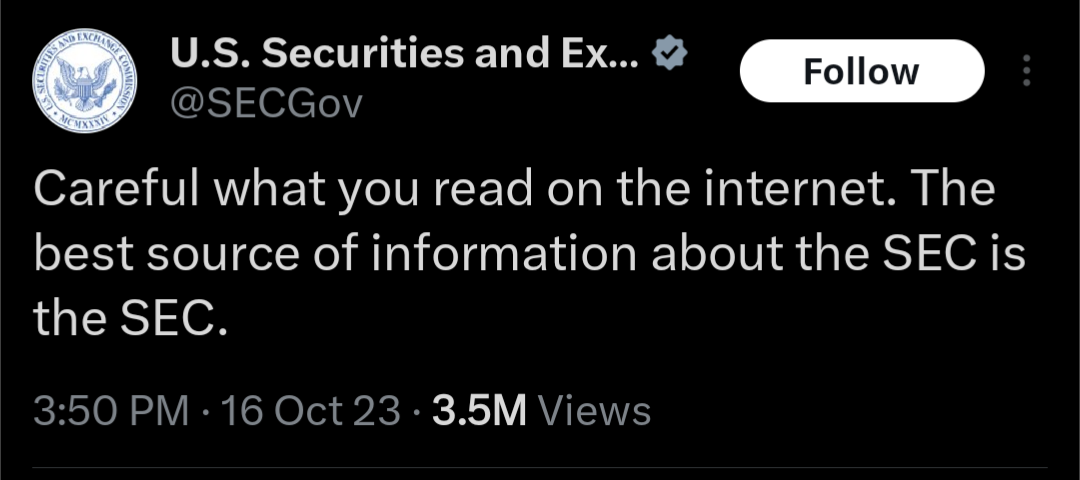

The situation also led to many people dunking on the regulator, especially given some of the ironic tweets it has sent in the past. For example, the tweet below says the SEC is the best source of information, but it certainly wasn’t today. 🙃

And they also pointed to Chairman Gary Gensler’s tweets about the importance of protecting your accounts from identity theft and fraud. We guess the regulator forgot to take its own advice… 🤦

Lawmakers who have been critical of the SEC under Chairman Gensler’s leadership used this as an opportunity to demand answers and accountability. Senator Bill Hagerty took to X to express his grievances against the regulator for causing a “colossal market-moving mistake.” 🧑⚖️

For now, crypto remains as volatile and uncertain as ever. Hopefully, the market will receive the clarity it’s searching for by tomorrow’s EOD deadline, but we’ll have to wait and see how this situation develops. 🤷