Cryptocurrencies are off to a strong start this week, as optimism around the spot Bitcoin ETF decision by the Securities & Exchange Commission (SEC) continues. 👀

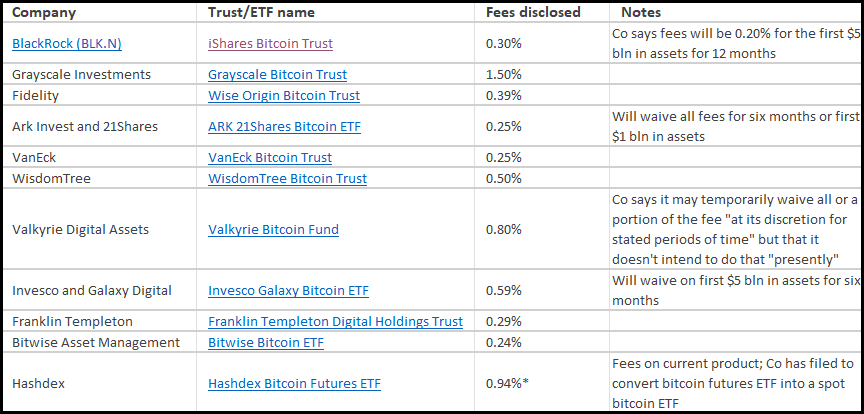

Nearly a dozen fund companies have filed the necessary paperwork to launch this investment vehicle. However, last week, the SEC requested asset managers make “minor” changes to their filings to disclose fees or identities of the market-makers for their ETFs. 📝

Issuers quickly amended their filings and resubmitted them by this morning’s 8 am ET deadline, providing more transparency into the pricing war happening as managers fight for market share.

On Friday, multiple issuers said they expect to receive final approval of S-1 filings by late Tuesday or Wednesday of this week.

That’s because the regulator has a January 10th deadline to respond to appeals from ARK 21 Shares to list its ETF. With that said, experts believe the regulator will greenlight (or reject) all the applications at once to avoid favoring any one specific company. ⌛

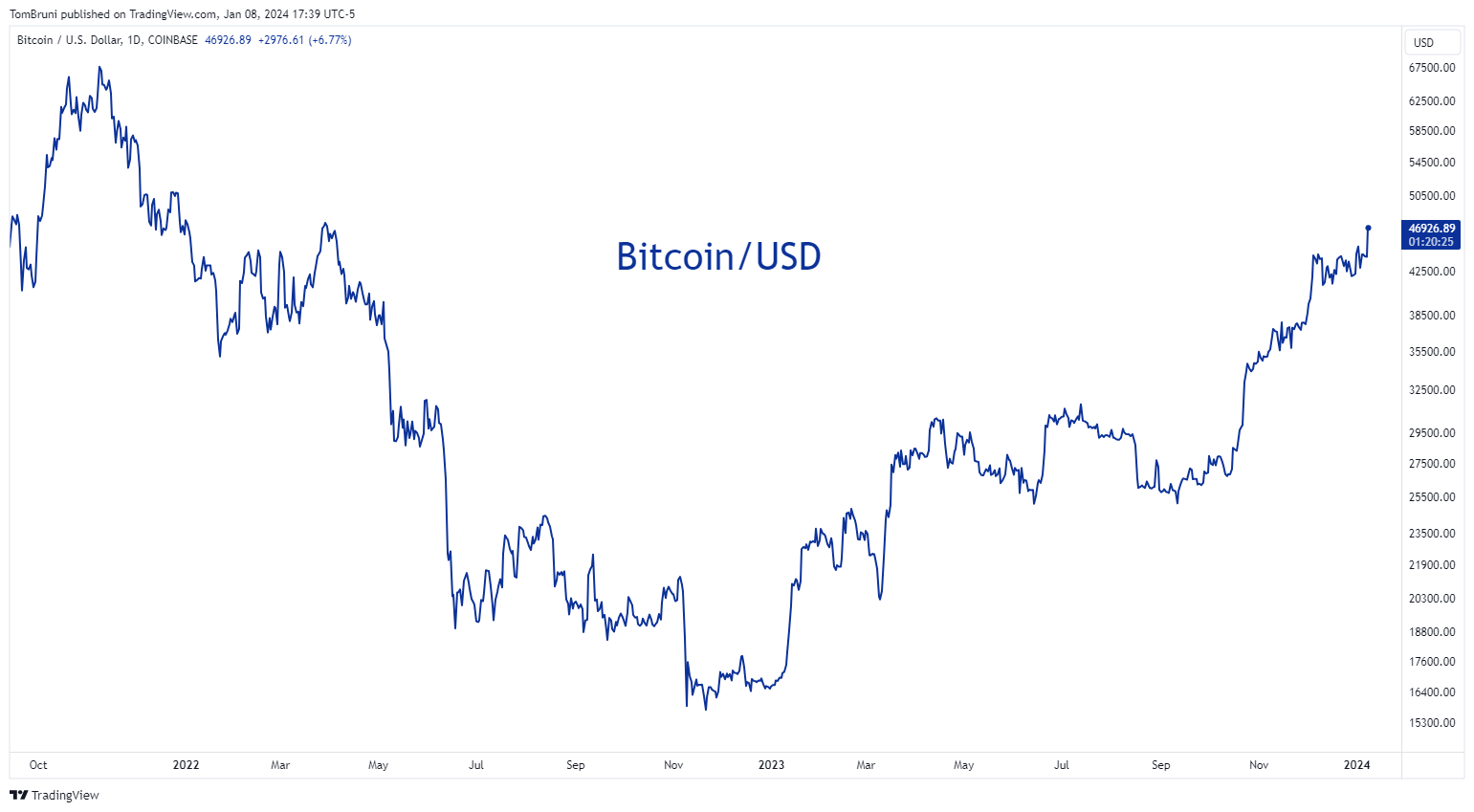

One might expect some trepidation in prices ahead of such a significant decision, but crypto bulls are clearly expressing their confidence that the approval is all but guaranteed. Former SEC chair Jay Clayton seems to believe so, too, calling it “inevitable.” Bitcoin rose to new cycle highs, closing at its highest level since April 2022. Crypto-related stocks also rebounded from their YTD drops. 🐂

For now, investors got a peek into what companies plan to charge as they look to capture their share of billions in expected inflows. Reuters has a solid chart below outlining the newest info.

With BlackRock coming in at 30 bps, others had to reduce their fees in a “race to the bottom” fashion. While it doesn’t appear that this specific ETF will provide the windfall asset managers had initially hoped for, they believe that once an ETF is approved, that will open the door for many more products they can sell to investors. 🔻

As for how much of this news is already priced into Bitcoin, that remains a heavily debated topic. Prices closed at roughly 21-month highs, so some of it is definitely already factored in. However, with several issuers poised to inject hundreds of millions into their new vehicles (if approved), many expect demand for Bitcoin to remain robust. 💰