Walmart, the largest U.S. retailer, reported mixed Q1 FY23 results before the opening bell. 🤷

Its adjusted earnings per share missed the $1.48 expected by analysts, coming in at $1.30. However, revenues beat expectations at $141.57 billion vs. $139.09 billion.

Chief Financial Officer Brett Biggs noted that the primary drivers of the EPS weakness were rising fuel prices/supply chain costs, high inventory levels, and overstaffing issues…all of which the company is working to address for future quarters.

Other highlights included:

- Gross profit fell by 87bps to 23.8%

- Total U.S. comparable sales ex-gas were +4.00%, vs. 2.26% expected

- Change in U.S. e-commerce sales +1%, vs 1.84% expected

Given most numbers were broadly in line with expectations, investors are focusing on the company’s updated full-year guidance. The company lowered its earnings-per-share expectations from a mid-single-digit increase to a 1% decline 🔻 and raised revenue expectations from 3% to 4% on a constant currency basis.

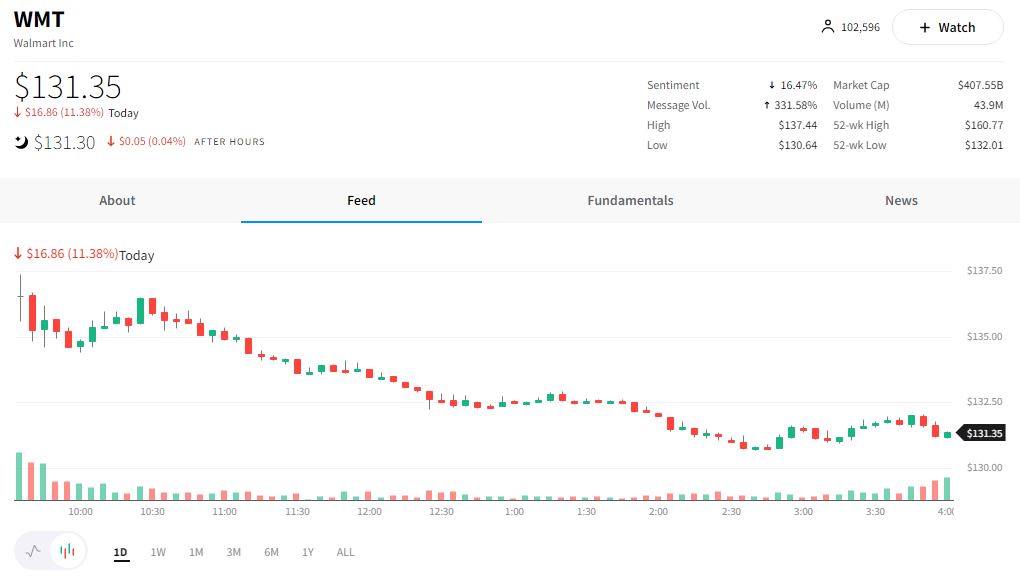

The stock gapped down in pre-market trading and trended lower throughout the day, closing off 11.38%. 📉

Today’s news from Walmart provided an important perspective on how retailers and consumers alike are dealing with inflation pressures. 🛍️

Supply chain costs remain a significant headwind on the retail side, with elevated fuel prices and wages. ⛽ Additionally, as the product mix shifts to lower-margin items like grocery, retailers may have to increase promotions to entice buyers of higher-margin items like electronics and apparel.

Meanwhile, consumers continue to shift their spending habits as residual effects from stimulus checks wear off, and inflation remains near 40-year highs. 🔥 The U.S. Retail Sales data reported today also suggested consumers are buying more services than goods as the weather improves and people spend more time outside their homes.

As long as inflation remains elevated, Walmart and the entire retail industry will need to walk a fine line between keeping prices low while not letting profits slip further. ⚖️

We’ll watch what Target’s earnings call adds to the conversation tomorrow before the market opens. 🎯