Jumia shares jumped 31% today after the company reported Q1 earnings. 💸

Here are the highlights:

- Revenue: +44% YoY to $47.6 million

- Orders: +40% YoY to 9.3 million

- Gross Merchandise Value (GMV): +27% YoY to $252.7 million

- Quarterly Active Customers: +29% YoY to 3.1 million

- JumiaPay Total Payment Value (TPV): +36.7% YoY to $70.7 million

Although investors are cheering these developments, growth comes at a cost. The company noted that it continues to spend heavily as part of its growth acceleration strategy. 💰

Adjusted EBITDA loss was $55.3 million for the quarter, up 70% YoY, due to the company’s investments in the areas of sales/advertising and technology/content.

The company’s guidance outlines that it expects an adjusted EBITDA loss of $200 to $220 million for FY 2022, with YoY losses expected to begin decreasing in 2023. 🔮

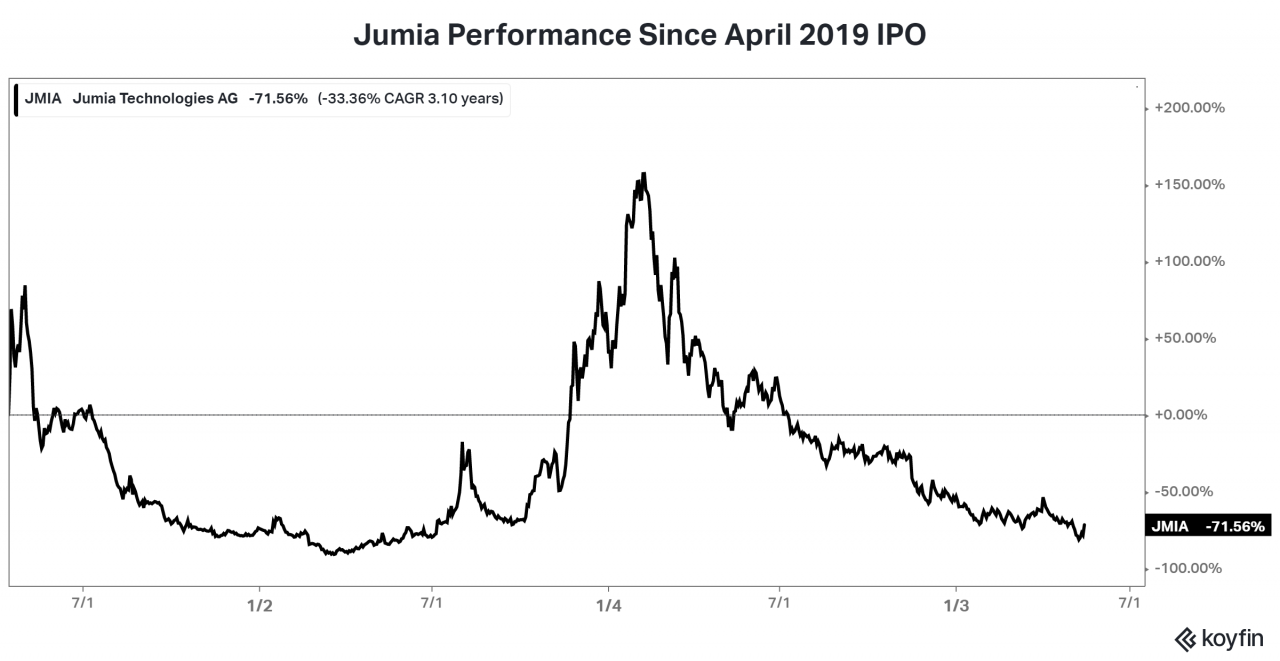

Even after today’s rally, the stock remains well below its April 2019 IPO price of $14.50.

So is this another failed rally attempt?💩 or the start of a more significant turnaround? 📈

Join the debate on the $JMIA stream!