We’re in the dog days earnings season, but some retail favorites are still reporting.

On the positive side, Chewy is rallying after its better-than-expected earnings. 📈

The company’s earnings per share beat analysts’ $(0.14) expected, coming in at $0.04. Revenues also beat expectations at $2.43 billion vs. $2.42 billion. 💚

In addition to these stats, the company’s gross margin declined just ten bps YoY to 27.5%. Investors watched closely to see how the retailer handled gross margins amid supply-chain issues and rising costs, so this news was a pleasant surprise.

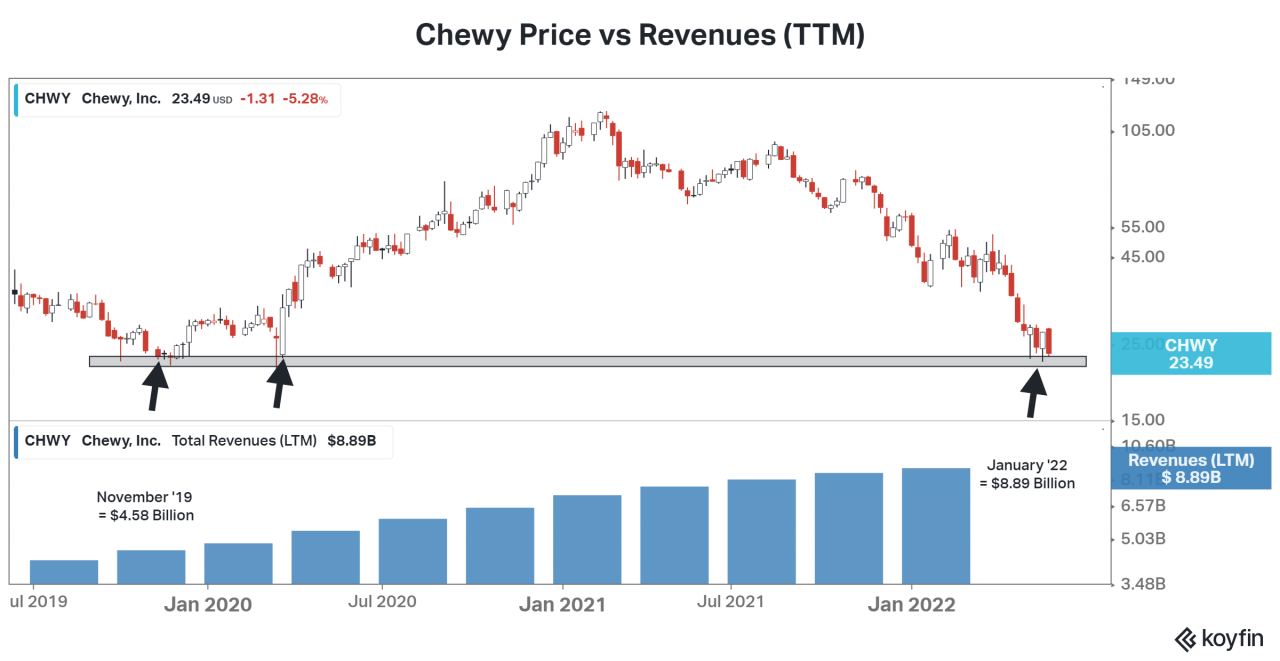

The company continues to make progress on the business side, but its stock is down more than 80% from its pandemic highs.

Much like the question Salesforce investors are asking after its earnings report, Chewy investors are likely trying to figure out how much cheaper the stock could get, given its already back at post-IPO lows. At the same time, revenues have doubled since then. 🤔

Meanwhile, GameStop investors expecting the company to “level up” this quarter were left disappointed. 🙁

The company reported a loss of $(2.08) per share on revenues of $1.38 billion, up slightly YoY from $1.27 billion.

Sales of collectibles rose, but hardware and software sales which make up the bulk of its business, both fell YoY. 📉

Meanwhile, the company did not provide any financial update on its non-fungible tokens (NFTs) marketplace that it plans to launch by the end of the current quarter.

Investors remain more or less in the blind as the company doesn’t feel it’s prudent to provide guidance as it transitions its business amid a challenging macro backdrop.

The stock initially popped 8.73% after hours before giving back most of those gains. 🔴

Given its share price is still well above its pre-pandemic highs, this trending ticker will likely remain front and center until this saga reaches its endgame. 👀