It’s been a rough ride for many tech investors over the last 18 months, but some companies and stocks are beginning to turn a corner.

Unfortunately, it doesn’t look like Zoom is one of them. ❌

Today’s report showed that it beat earnings per share ($1.05 vs. $0.94 expected) but missed revenues ($1.10 billion vs. $1.12 billion).

The company’s revenue growth slowed to 8% YoY, down from 12% last quarter, and its net income fell significantly on the back of higher sales and marketing spending. 🔻

While a strong U.S. Dollar also played a role in the revenue miss, the company is struggling to get growing again. As a result, its management lowered its earnings and revenue projections for its full 2023 fiscal year.

Overall, the company’s business continues to shift back toward enterprise customers and hopes that its new pricing structure, Zoom One, can help it reach its future financial projections. Investors better hope they’re right because it doesn’t sound like they’ve got any better ideas. 🤷♂️

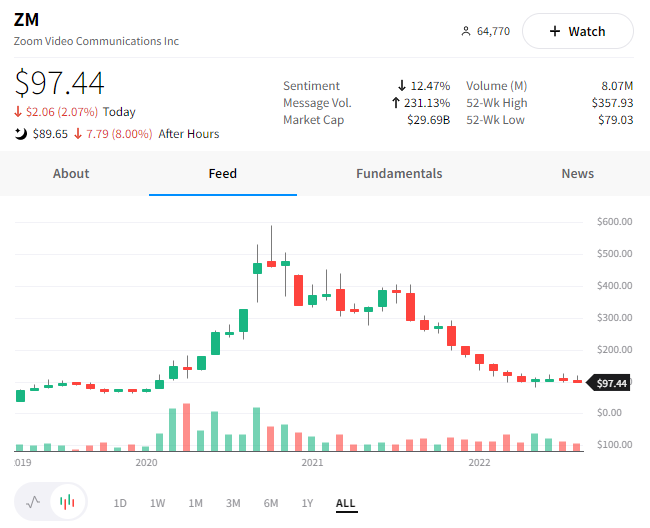

For now, the gloomy outlook remains in place, as the shares were down roughly 10% today. ⛈️