Chinese e-commerce company Pinduoduo continued its rally after reporting better-than-expected earnings and revenue. 👍

The company reported $4.69 billion in revenue, marking a 36% YoY rise, driven by strong sales during China’s midyear shopping festival. In addition, pent-up demand as Covid-19 restrictions loosened helped drive sales and proved the resilience of China’s consumers. 🛒

Profits surged 268%, but the company cautioned that it was related to the delay of several projects and reduced costs due to Covid restrictions. Executives noted that the company would continue to prioritize R&D to stay competitive and confirmed rumors that it is considering expanding overseas.

This isn’t much of a surprise to anyone paying attention. As China’s consumers get pinched by inflation and slowing wage growth, many Chinese companies are turning to international markets to reaccelerate growth. 🗺️

Additionally, on Friday, The Public Company Accounting Oversight Board (PAOB) said it signed an agreement with Chinese regulators which allows it to audit U.S.-listed Chinese companies without consultation or input from Chinese authorities. The delisting threat was a significant concern for many of these stocks, so the agreement should help decrease their overall volatility.

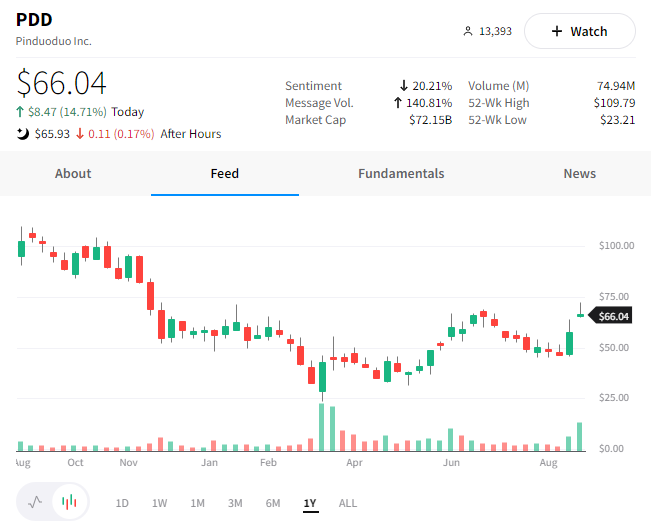

Investors seem happy with the news, given the stock added to last week’s 25% gain and reached its highest level of 2022 intraday. 📈