Concerns about the health of the U.S. economy continue, with steel manufacturer Nucor adding more fuel to the fire. 🔥

The company will announce its third-quarter earnings sometime in mid-October, but today it warned that it’s tracking to miss estimates. The $31 billion metals giant now expects to earn $6.30 to $6.40 per share, well below estimates of $7.56, attributing the miss to “metal margin contraction and reduced shipping volumes, particularly at our sheet and plate mills.”

Steel prices rose sharply during 2020 and 2021 due to supply-chain constraints but have fallen significantly since then. As a result, Nucor and other steel producers will likely see their profits squeezed as supply in the market increases.

And while the company didn’t mention economic conditions, the market can’t help but wonder if this is another sign of a broader economic slowdown. 🤔

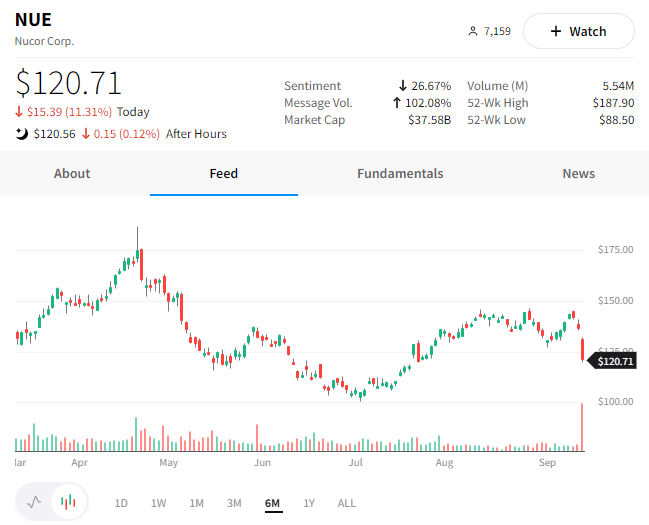

Some investors aren’t waiting around to see. Instead, they’re selling first and asking questions later. $NUE shares fell 11%, with its competitors Steel Dynamics and U.S. Steel also dropping. 🔻