Based on the title, you’d think we’re talking about the money supply or some other economic term.

But you’d be wrong. 😜

Today, we’re talking about unlimited breadsticks because Olive Garden’s parent company Darden Restaurants reported earnings. 🥖

Results were mixed, with its earnings per share of $1.56 meeting estimates. However, its revenues of $2.45 billion missed expectations by $0.02 billion.

CEO Rick Cardenas said that inflation is weighing on consumers, especially those households with incomes under $50,000. But, so far, there’s a slight change in behavior from that consumer. That said, Darden is trying to draw customers by limiting how much of its rising costs it passes on to its customers.

Despite its efforts to lure customers, Olive Garden’s same-store sales rose 2.30%, and LongHorn Steakhouse rose 4.20%, both missing estimates. However, overall same-store sales rose 4.20%, buoyed by the performance of its fine-dining restaurants like The Capital Grille.

While sales slump, inflation continues to eat into the company’s operating profit. Its menu prices rose 6.50% in the quarter while trailing total inflation rose 9.50%. 🔺

Overall, Darden stood by its outlook for fiscal 2023 as it predicts inflation will cool in the coming quarters. As a result, it expects EPS from continuing operations of $7.40-$8.00. It also expects revenue of $10.20-$10.40 billion. Lastly, it forecasts same-store sales growth of 4%-6% and 55-60 new restaurant openings.

The restaurant operator spoke about many of the same themes we’ve been hearing about the consumer and overall macro environment. Unfortunately, while the company seems optimistic about inflation coming down and its operating results, investors appear less so.

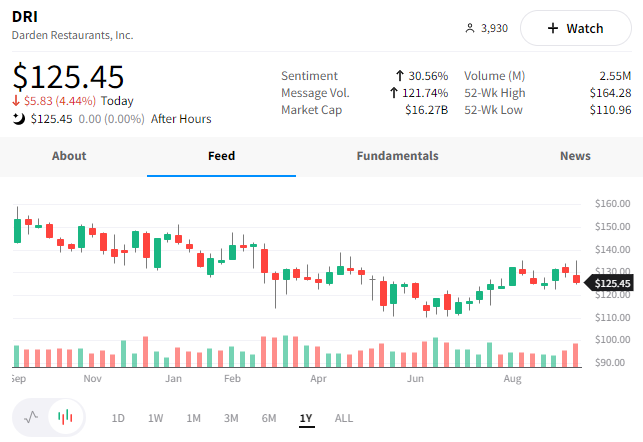

$DRI shares were down 4.44% today and remain 25% off their all-time high. 📉